I recently wrote an article entitled “Consider Equity REITs for Your Next Investment“. In that article, I listed nine equity REITs (eREITs) for dividend investors to consider in light of the drubbing that eREIT valuations have recently taken due to fear of rising interest rates and to capitalize on the pass-through provision for REIT income included in the new tax legislation.

Both of these topics are covered in some detail in the previous article. This article provides a more complete investment thesis for Welltower, Inc. (HCN) one of the nine eREITs highlighted in the previous article.

Welltower, Inc.

Welltower is one of the larger healthcare eREITs in the US with an enterprise value of roughly $33B and more than 1330 healthcare properties/assets consisting primarily of Senior Housing Developments located in the US, the United Kingdom, and Canada as well as Post Acute Care Facilities located in the US. HCN has very little exposure to Medicaid and/or Medicare payment structures with roughly 93% of its revenues generated through operators relying on private pay or private insurance reimbursement for senior housing and healthcare services.

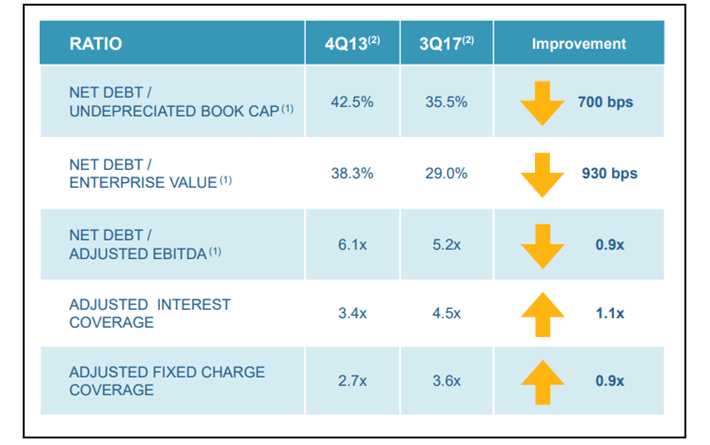

Welltower maintains a strong balance sheet with conservative use of debt and carries a BBB+ credit rating. The chart below shows four critical metrics for HCN’s balance sheet.

Source: Welltower Investor Site

The bottom three metrics are particularly important as they show that HCN’s net debt including preferred stock issues is manageable with respect to EBITDA and the interest on debt and preferred dividend payments (fixed charges) is well covered by EBITDA. These are the metrics that are important to maintaining an investment grade credit rating and allows HCN to issue more debt for growth acquisitions at favorable (i.e. low) rates.

Welltower’s continuing growth strategy is focused on projected demand growth in senior housing and post-acute medical care (short and long-term). Senior housing (independent and assisted living) demand is projected to grow at roughly 8% per year over the next 20 years.

Leave A Comment