Constellation Brands Inc. (STZ – Free Report) delivered stellar second-quarter fiscal 2019 results, wherein the top and bottom line surpassed estimates and improved year over year. Also, the company’s earnings reverted to its 14-straight quarters of positive streak after a miss in the previous quarter, with third positive sales surprise. As a result, management raised its earnings guidance for fiscal 2019.

Following the earnings release, shares of Constellation Brands increased 4.4% in the pre-market trading session. However, this Zacks Rank #5 (Strong Sell) stock has lost 2.3% in the past three months, narrower than the industry’s 6.4% decline.

Q2 Highlights

The company’s adjusted earnings for second-quarter fiscal 2019 increased 16% year over year to $2.87 per share and outpaced the Zacks Consensus Estimate of $2.58. Moreover, reported earnings were $5.87 per share, up 136% year over year.

Net sales improved 10.1% to $2,299.1 million and came above the Zacks Consensus Estimate of $2,248 million.

At the company’s beer business, sales improved 10.5% driven by an 8.7% rise in shipment volume and depletions growth of 10.1%. Solid portfolio depletions and market share gains mainly stemmed from the strength in Modelo and Corona brand families.

During the reported quarter, the company witnessed significant momentum from the new product launches, including Corona Premier and Familiar. Notably, the company’s beer business was the top share gainer in the U.S. beer market in the fiscal second quarter, courtesy of gains from Corona and Modelo Especial’s brands.

Further, wine and spirits segment’s sales were up 9.3% owing to 8.8% growth in shipment volume and 0.2% rise in depletions.

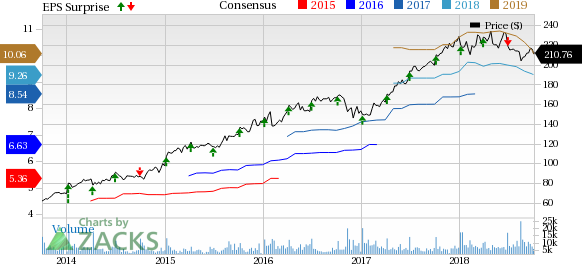

Constellation Brands Inc Price, Consensus and EPS Surprise

Constellation Brands Inc Price, Consensus and EPS Surprise | Constellation Brands Inc Quote

Margin Performance

Adjusted gross profit improved 10.8% year over year to $1,180 million. Also, adjusted gross profit margin expanded 30 basis points (bps) to 51.3%.

Leave A Comment