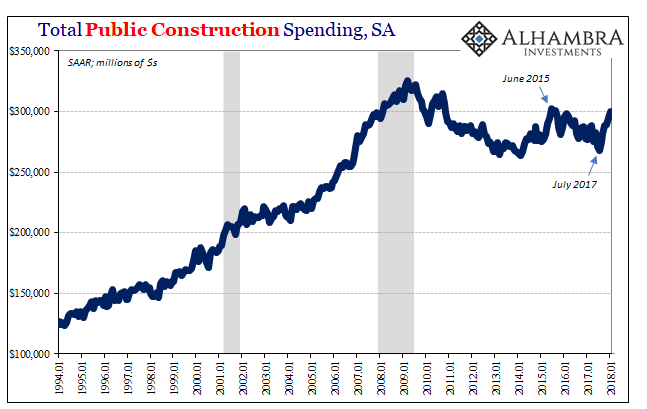

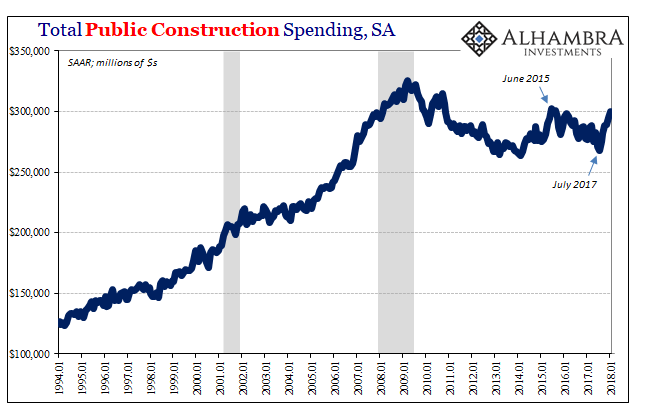

Public construction spending has rebounded since July last year on what looks to be storm-related cleanup costs. The Census Bureau unfortunately does not break down total spending by geographic region, which, obviously, would clarify whether or not this has been the case. For now, absent also estimates for Q4 state and local tax collections, we will have to be content noting the timing of the upward turn which corresponds directly with Harvey and Irma’s arrivals as well as their immediate and messy aftermath.

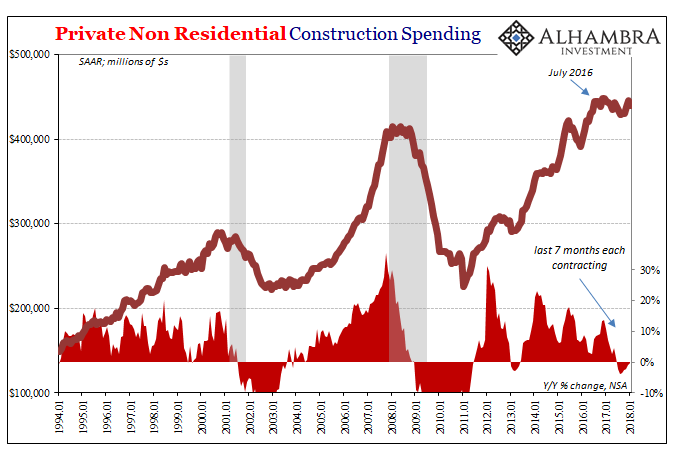

On the private side, there is less positives to report regardless of reasons. For some time now, businesses have become clearly reluctant to invest in physical facilities, at least domestically. For January, Private Non-residential Construction Spending was down slightly. It’s not the magnitude of the decline that is worth mention, rather it is the continued duration as well as the timing.

That latter dimension does not, I don’t think, correspond with the hurricanes since the slowdown long predates them. It is impossible to say for sure that there weren’t any negative effects at all, or positives for that matter, only that unlike in public construction activity there is no obvious correlation (with the hurricanes) as far as the calendar.

This is in every way contrary to economic “reflation” sentiment that in markets at least began around the very same time. For any true economic boom to manifest, it will have to start on the so-called supply side. Construction spending is not a comprehensive estimate for total capex, but it is a reasonable proxy for intentions.

Thus, if the US and global economy was on the verge of some serious acceleration why isn’t it happening here? What is suggested is an increase in caution about macro factors, not an easing or even alleviation of them. Furthermore, the timing and the direction correspond only too well with the slowdown in the labor market, another hefty financial commitment that along with capex suggests in action how companies view the economy as it is apart from mainstream commentary (or surveys about business and manufacturing sentiment).

Leave A Comment