The latest Conference Board Consumer Confidence Index was released this morning based on data collected through August 16. The headline number of 122.9 was an increase from the final reading of 120.0 for July, a downward revision from 121.1. Today’s number was above the Investing.com consensus of 120.3.

Here is an excerpt from the Conference Board press release.

Consumer confidence increased in August following a moderate improvement in July,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ more buoyant assessment of present-day conditions was the primary driver of the boost in confidence, with the Present Situation Index continuing to hover at a 16-year high (July 2001, 151.3). Consumers’ short-term expectations were relatively flat, though still optimistic, suggesting that they do not anticipate an acceleration in the pace of economic activity in the months ahead.”

Putting the Latest Number in Context

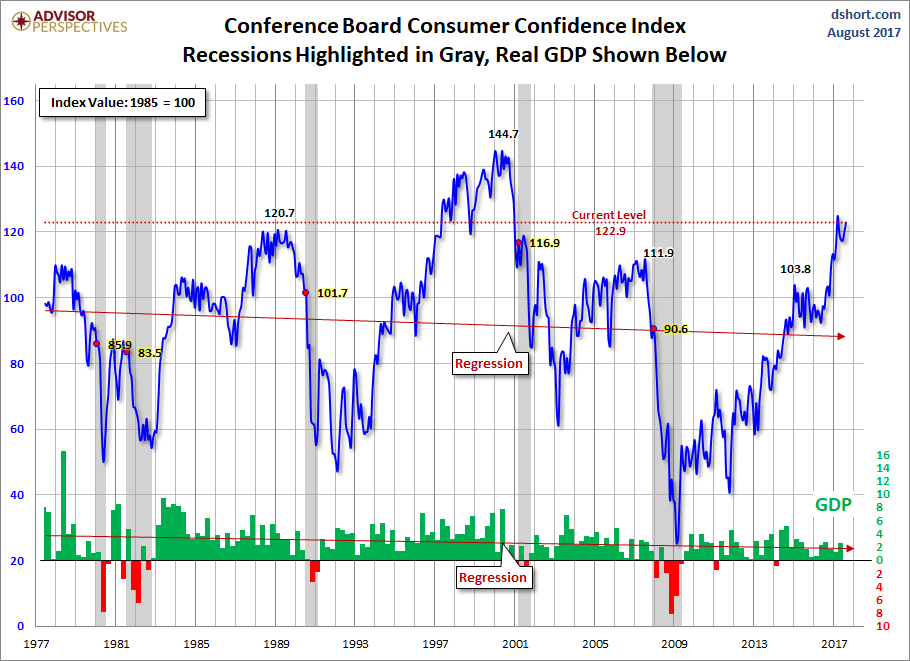

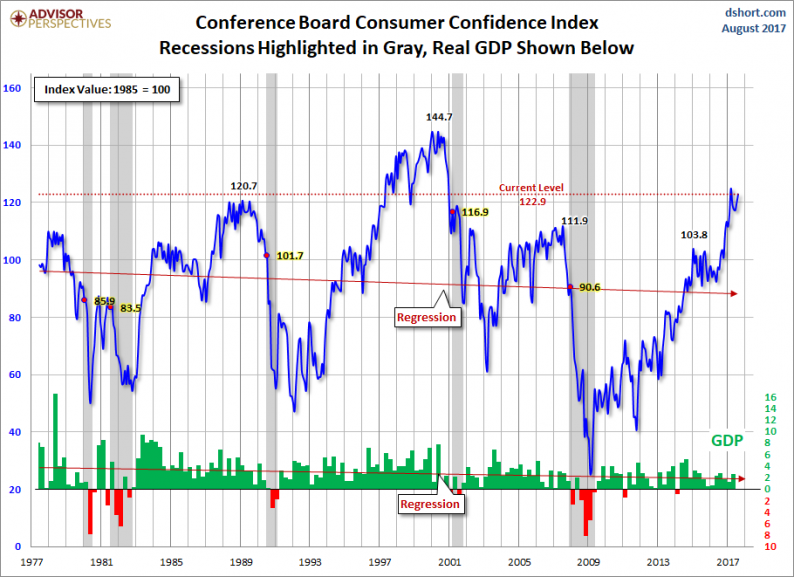

The chart below is another attempt to evaluate the historical context for this index as a coincident indicator of the economy. Toward this end, we have highlighted recessions and included GDP. The regression through the index data shows the long-term trend and highlights the extreme volatility of this indicator. Statisticians may assign little significance to a regression through this sort of data. But the slope resembles the regression trend for real GDP shown below, and it is a more revealing gauge of relative confidence than the 1985 level of 100 that the Conference Board cites as a point of reference.

On a percentile basis, the latest reading is at the 91st percentile of all the monthly data points since June 1977, up from the 90th percentile the previous month.

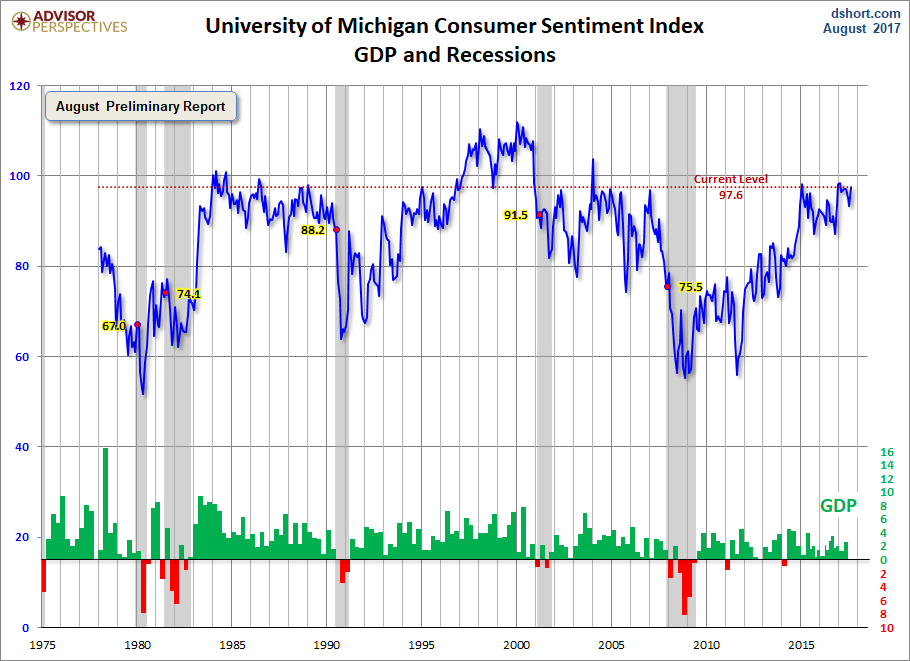

For an additional perspective on consumer attitudes, see the most recent Reuters/University of Michigan Consumer Sentiment Index. Here is the chart from that post.

Leave A Comment