According to the Conference Board, US consumers are sky high. The business association’s index measuring consumer confidence jumped to a level it hasn’t seen since the apex of the dot-com days. Though I’m not sure that’s really a positive reflection on the economy, the mainstream verdict is as usual quite different.

U.S. consumer confidence surged to near an 18-year high in August, as households remained upbeat on the labor market, pointing to strong consumer spending that should help to sustain the economy for the remainder of the year.

Nothing but good things as far as the consumer is “feeling.” So, where is the spending? It’s just not there, though everything you hear makes it seem like it is.

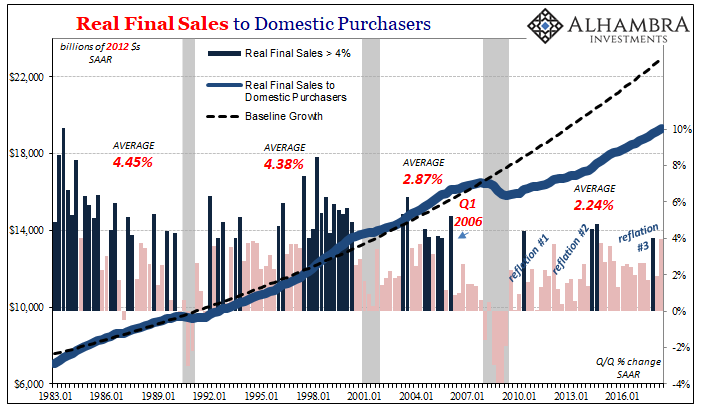

After all, GDP in Q2 2018 was just revised a tic higher to 4.2% (Q/Q SAAR). Within that number, Real Final Sales to Domestic Purchasers, the most exhaustive and comprehensive estimate for consumer and business spending on everything from goods to services no matter where they are produced, grew by just less than 4%. In fact, that makes two out of the last three quarters above or near a 4% annual growth rate. Booming!

But these rates only stand out because everything has been so awful for so long. The average gain since the end of the Great “Recession” has been a pitiful 2.24%. Compared to that, 4% does look awesome.

Before the housing bubble collapsed in the middle of 2006, however, consumer spending used to average better than quite a bit more than 4%. In this environment of surging consumer confidence, consumers manage to spend at rates that were once below average – and it looks like a splurge compared to recent imposed frugality.

It shows that the economic problems in 2018 are really two problems, both of which reach all the way back a decade and more. We no longer recognize a truly strong economy when we see one because we haven’t seen one is so many years. Consumers may be confident, but that’s clearly nothing more than stock market noise (thus, the dreaded comparison to the dot-com era).

Leave A Comment