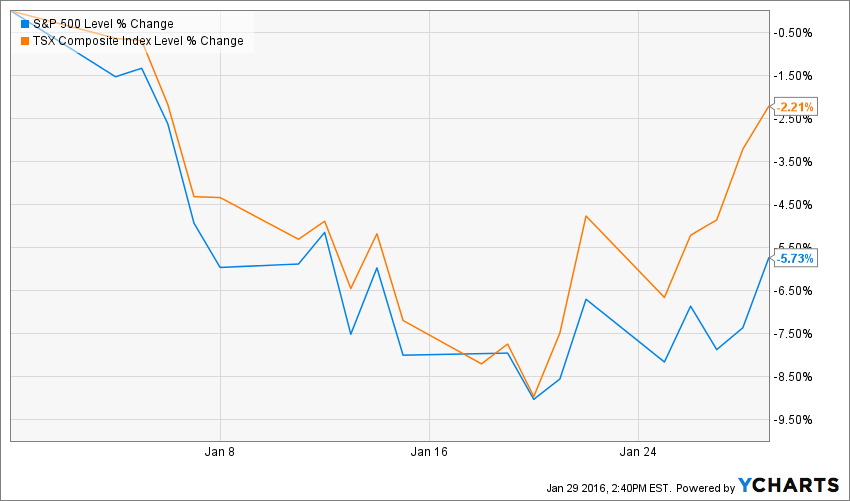

The month on the stock market has been quite hectic but it seems that earnings are bringing back some calm to the Street.

We see that after January 20th, the market started to bounce back after good earnings’ reports. It is still unclear if we will suffer a bear market or are just going through a correction with greater volatility. On the Canadian stock market, we hit the -20% return from the TSX summit of 2015 and can technically call it a bear market. However, we don’t need much to turn around and rise back up as you can see on the previous graph. One thing is for sure; consumer defensive stocks will help you endure these fluctuations.

Consumer Sentiment & Goods Sales

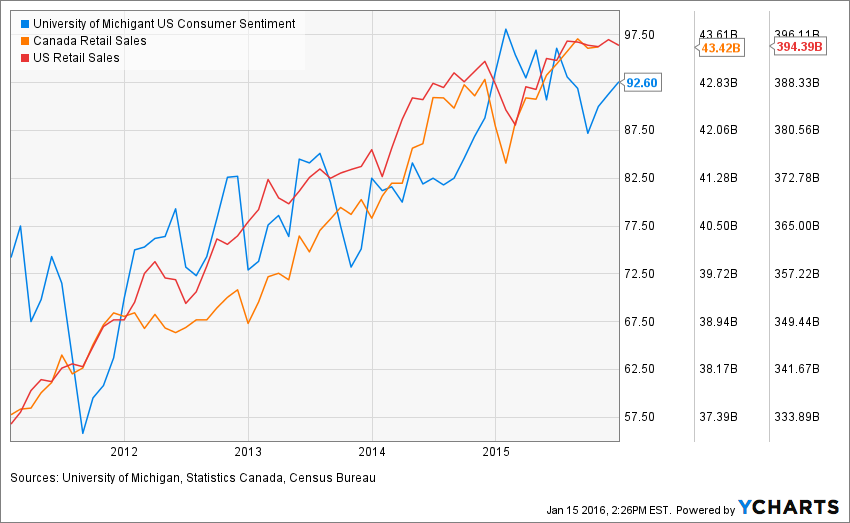

In 2015, we saw retail sales rise in both the US and Canada. However, the US consumer sentiment wasn’t as straightforward as sales. This is a good example of how the Media can influence consumers to think differently. Back in July 2015, Chinese market worries started to rise. Interesting enough, consumer sentiment went down with the Chinese market… along with North American stock markets too.

Americans gained back some trust in the economy after many companies posted their earnings in October and November. By looking at a single year, you may think the consumer sentiment is still on a downtrend since it finished the year 6 points lower than it started. Let’s take a look at the bigger picture.

If you look at the past 5 years, we can see how the three metrics are heading in the same direction. Retail sales seem to stagnate in 2015, but we may as well have reached another plateau as experienced in 2014.

There are several factors leading us to think that the consumer defensive sector will perform well in 2016. A low unemployment rate in the USA along with lower gasoline prices will encourage customer to keep buying goods. While the oil industry is suffering in Canada, the overall economy is sending signs of resilience. The $10 billion infrastructure spending plan should help the Canadian economy as stated by Stephen Poloz, Bank of Canada Governor.

Leave A Comment