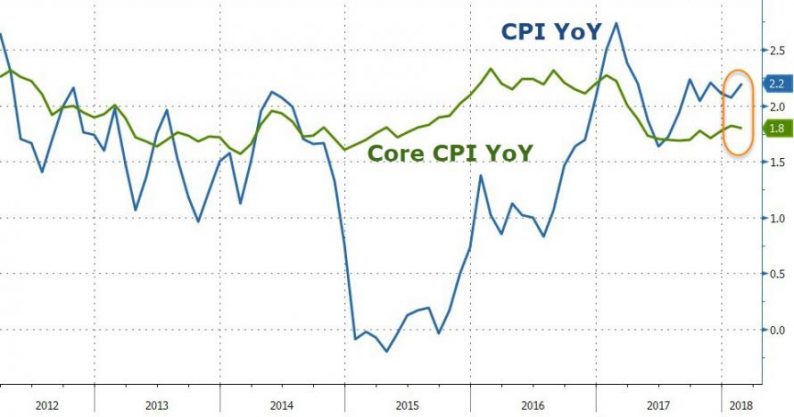

January’s Core CPI spiked rates over 12bps but since then they have fallen back to almost unchanged and rallied into today’s February print, suggesting a miss.

However, February CPI printed higher than January, rising 2.2% YoY as expected. However, Core CPI slowed from January to 1.8% (es expected). Drops in new and used vehicles, food, and fuel prices helped steady the consumer cost rise.

Under the hood, subcomponents show a very mixed message…

The index for all items less food and energy increased 0.2 percent in February. The shelter index increased 0.2 percent, with the indexes for rent and owners’ equivalent rent both rising 0.2 percent and the index for lodging away from home unchanged.

The apparel index continued to rise, increasing 1.5 percent in February following a 1.7-percent rise in January. The index for motor vehicle insurance also continued to increase sharply, rising 1.7 percent in February.

The index for household furnishings and operations rose 0.3 percent in February. The education index increased 0.2 percent, as did the index for personal care. The indexes for alcoholic beverages and tobacco also increased in February.

Notably, looking at next month, the annual growth rate of core CPI will mechanically rise by around 20bps in the March data release just from annualizing the -10% decline in wirelesstelephone services. This should help core CPI to exceed +2.0% yoy in March.

Finally, we note that 10Y Treasury yields are 2bps higher than before the January CPI print that spiked rates 12bps higher…

Leave A Comment