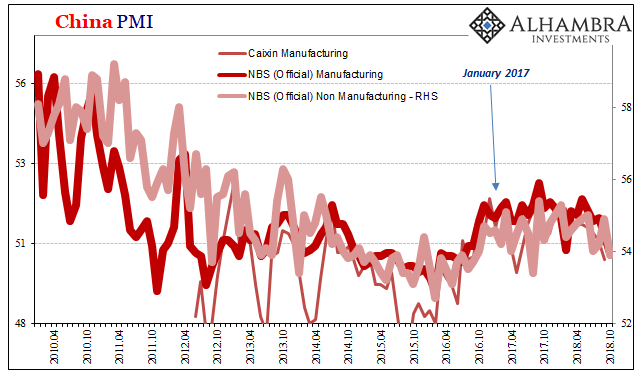

Overseas turmoil continues in October. The Chinese government released its Purchasing Managers Indices (PMI) for both manufacturing and services. Each one came in at a multi-month low. The National Bureau of Statistics calculated that the manufacturing version was just 50.2 this month, the lowest level since July 2016. The Non-manufacturing PMI fell sharply to 53.9 from 54.9 in September. October’s index was below 54 for the first time since July 2017.

The direction of China’s economy is no longer in doubt. These sentiment estimates, regardless of their proximity to the 50 line, are consistent with recent economic accounts showing a downturn already underway. Given yesterday’s GDP estimates for Europe, this isn’t an economic development exclusive to China.

The question is why. The most mainstream commentary will offer is trade war stuff. On the surface, it seems plausible. Even in October’s manufacturing PMI, new orders for the export of goods contracted. Below 50 for the fifth consecutive month, at 46.9 the latest reading is the worst export indication for China since the very dark days of January 2016.

While that could be consistent with trade restrictions being imposed, it is at least consistent with already several times in the past when there were no such pains. China didn’t require an American trade backlash in 2015 and 2016 to get to the same weak point, it merely reflected more fundamental prospects – another worldwide downturn triggered by monetary retrenchment (“rising dollar”) in the actual global reserve currency (eurodollar, not dollar).

Likewise, late 2011 and early 2012. Back then, mainstream commentary had fixated on currency wars as out of the orthodox Economics textbook to try to explain that particular uniform global disruption. It was widely believed the US government with the aid of the Federal Reserve was intentionally attempting to weaken the dollar via QE; a beggar-thy-neighbor policy of taking from others for its own gain. When the opposite happened, there was no more talk of currency wars.

Leave A Comment