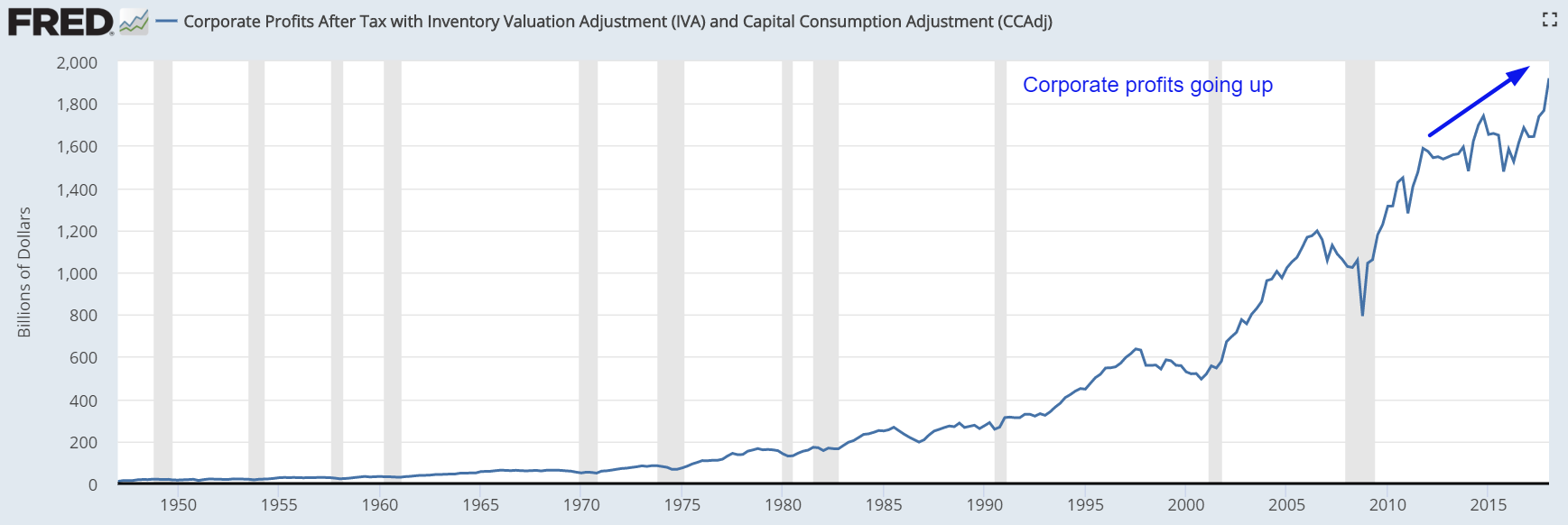

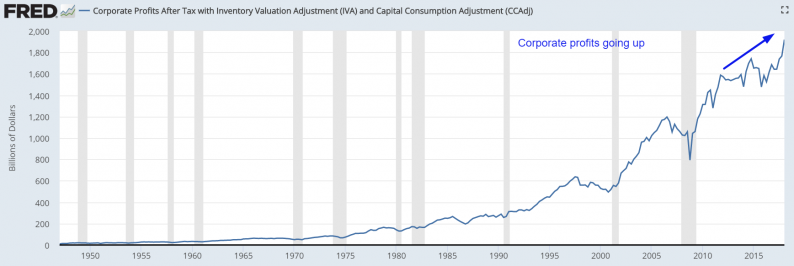

As we’ve demonstrated here at BullMarkets before, the U.S. economy, corporate profits, and stock market all move in the same direction in the medium-long term.

The final reading for Q1 2018 GDP (released June 28, 2018) demonstrates that corporate profits are still rising. And for all the people who think that earnings numbers are “manipulated” via GAAP rules, these are corporate profits according to the IRS. Fact.

But of course, nominal numbers (e.g. nominal corporate profits) are meaningless. Nominal numbers will always go up in the long term due to inflation. That’s why we care more about the inflation-adjusted corporate profits.

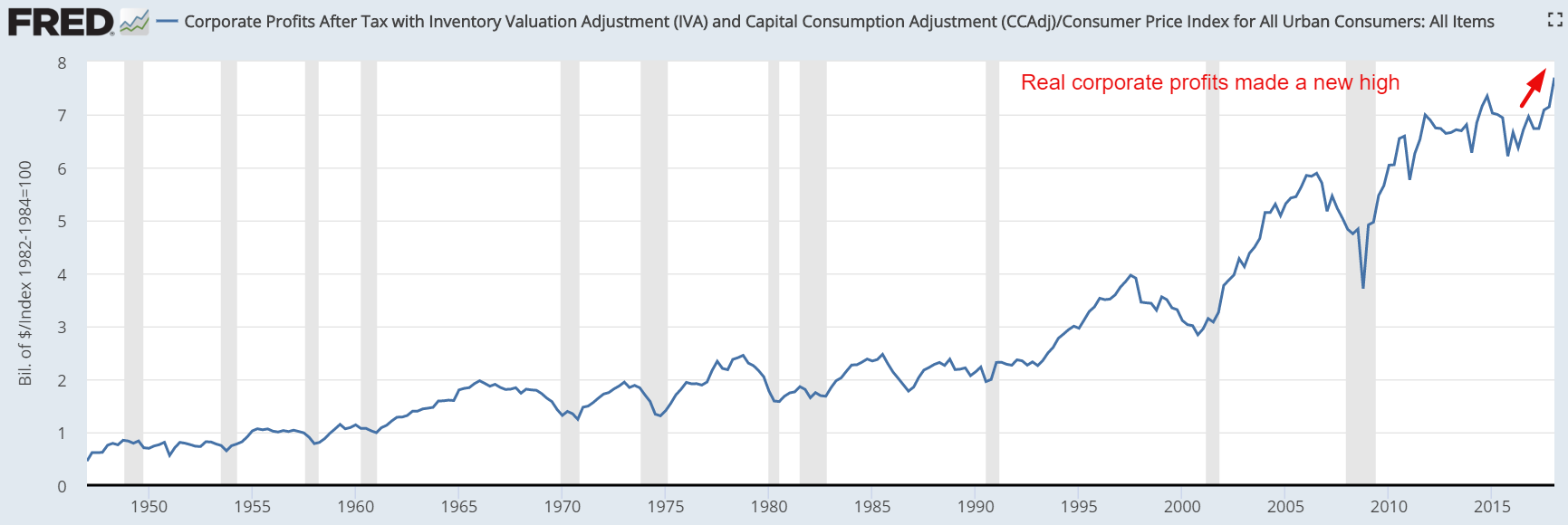

As you can see, real (inflation-adjusted) corporate profits made a new high as well. Real corporate profits tend to trend downwards before an economic recession begins.

Real corporate profits also trend downwards before an equities bear market begins.

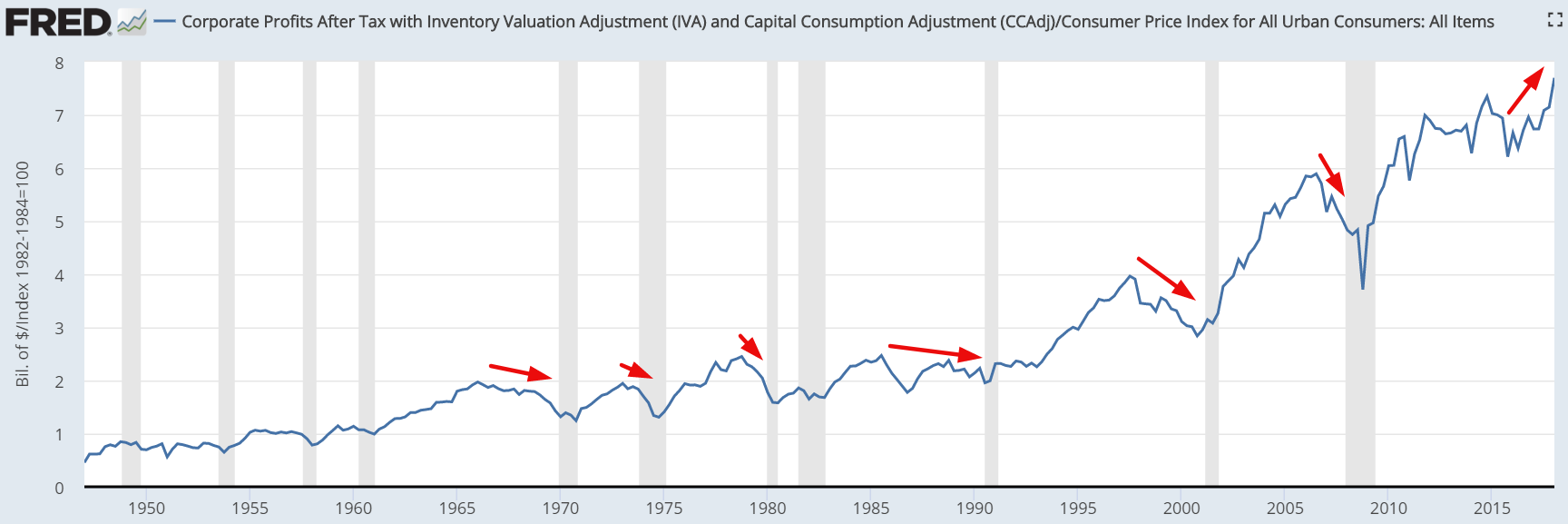

December 1968

The S&P 500 peaked in December 1968. Corporate earnings peaked in Q1 1966, almost 3 years before the stock market peaked.

January 1973

The stock market topped in January 1973, along with corporate earnings. However, this bear market wasn’t supposed to start off as a bear market. The Medium-Long Term Model predicted it as a “significant correction”, but as new data came along, the Model turned the “significant correction” prediction into a “bear market” prediction.

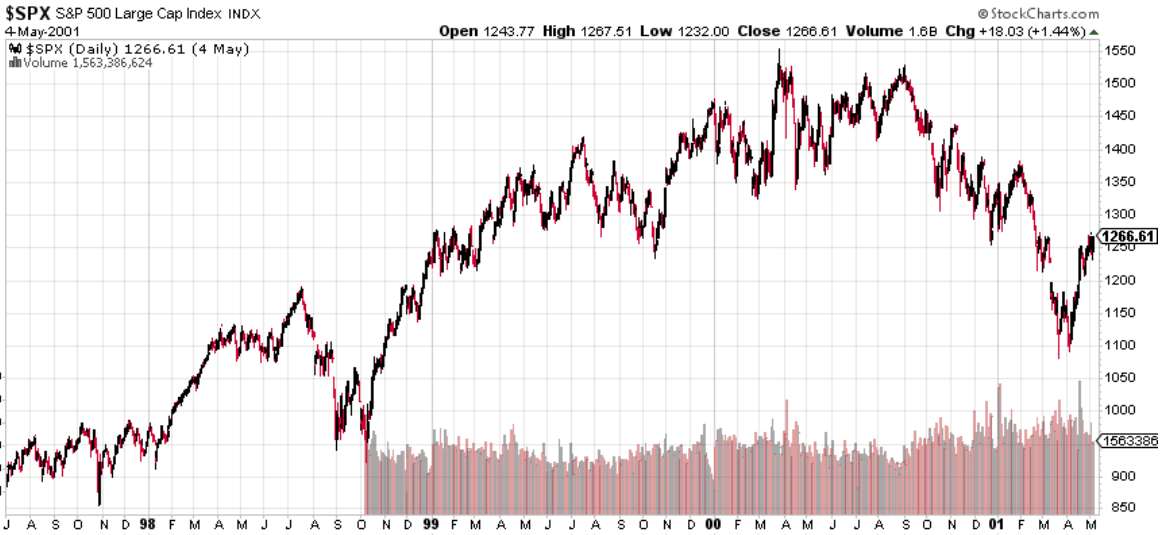

March 2000

The S&P 500 peaked in March 2000. Corporate earnings peaked in Q3 1997, 2.5 years before the stock market peaked.

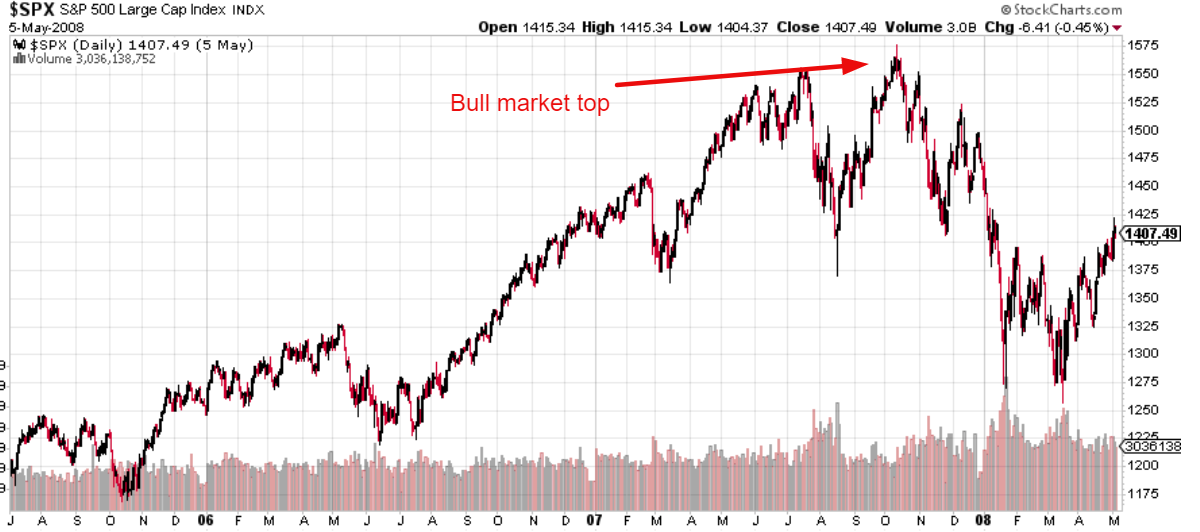

October 2007

The S&P 500 peaked in October 2007. Corporate earnings peaked in Q3 2006, 1 year before the stock market peaked.

Corporate earnings also top before economic-driven “significant corrections” for the stock market. For example, corporate earnings topped in Q4 1988. The next “significant correction” began in July 1990.

Leave A Comment