Introduction

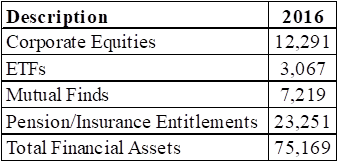

About half of all Americans own stocks, either individually, in pension plans, or via mutual funds/ETFs. A breakdown of their holdings appears in Table 1. Note that individual holdings are greater than their mutual funds/ETF holdings combined.

Table 1. – US Individual Holdings (bil. US$)

Source: Federal Reserve, Investment Company Institute

There are many ways that “behind the scenes” activities could be hurting investors, including corruption. Corruption? Is that not being a bit extreme? Maybe not. Why else was an organization formed to promote five core principles for investment advisers:

One might wonder why such a standard is needed. The answer is because the financial industry is rife with potential conflicts of interest and corruption. There are at least two important ways in which equity owners might be affected:

Executing Trades

Equity brokers must, under federal trading rules, provide “best execution.” That means in part getting the best stock prices for clients. But not all buyers are treated in the same way. And commissions from trades differ. The rules also recognize that for some trades, getting the best price is only one part of best execution. The speed, size and other costs of a trade must also be considered.

Research presented at Senate hearings show that under the guise of making subjective judgments about best execution, brokers were routinely sending orders to venues that paid the highest rebates. For example, in the last quarter of 2012, the brokerage TD Ameritrade sent all nonmarketable customer orders — those that can’t be completed immediately based on the market price — to the one exchange that paid the highest rebate. In the first quarter of 2014, it sent nonmarketable orders to two venues that paid the highest rebates.

Are these rebates really bribes? I quote Senator Carl Levin, Chairman of the Senate Permanent Subcommittee on Investigations: “It is a frankly pretty incredible coincidence” that TD Ameritrade’s judgment on best execution invariably led it to use the brokers that paid the highest rebates. Under questioning, an executive of TD Ameritrade conceded that in the trades cited by Levin, the firm had almost always used exchanges that paid the most. He also estimated that the firm made $80 million in one year from maker-taker rebates. I cite TD Ameritrade only as an example of a practice that is widespread.

Leave A Comment