You do have to wonder to whom the increasingly shrill bond market declarations are being directed. It’s very likely that Bloomberg’s now daily haranguing “the yield curve can’t possibly be right” tirades aren’t meant for UST investors. Rather, it is perfectly evident that the treasury market is going to do what it does regardless and that the media, in general, is instead simply trying to muddy its very clear negative signal for whoever might not be familiar enough.

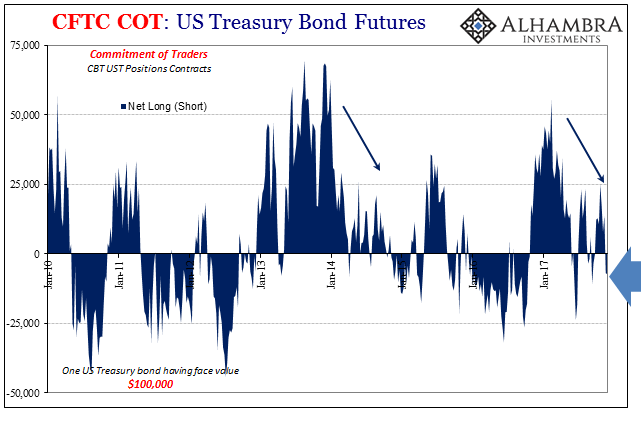

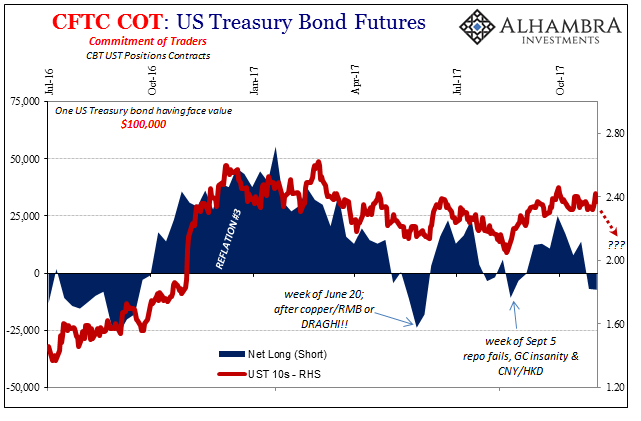

For one thing, the bond market just isn’t listening to the parade of excuses. By bond market I mean, of course, the UST futures market. Over the last few weeks of November, about the same time as the anti-flat rhetoric was really amped up, the futures market turned net short once again. The Commitment of Traders (COT) report for UST futures shows more than a little disdain among traders for the mainstream commentary.

It would suggest the path of least resistance for UST rates at the long end, at least, is even more now in the wrong direction than it was to start last month (at a slightly net positive position). At the very least, there is more than enough financial positioning to offset any spillover influence from the widely expected December “rate hike’s” effects on the whole curve (pushing up short rates for money alternatives).

There’s more breaking down than just UST futures, of course. We have to note the signal from copper, particularly as it relates to both Treasury yields as well as CNY (with and without Hong Kong). Today was not a good day for Dr. C, with the price falling sharply. Given where CNY has been, and it looks more and more like the PBOC is quite active again at ~6.62, the drop may have been a belated adjustment for the last runup that wasn’t really supported by these “dollar” conditions.

And it’s not just copper where we detect China’s “dollar” fingerprints. Gold, for instance, has been trading far more correlated with CNY than even JPY, a remarkable change given how closely gold prices tracked the yen exchange at least until July (which is when the last downturn in UST yields materialized, the one that matched perfectly if inversely CNY’s gold-correlated rocket ascent).

Leave A Comment