Looking at this week’s Commitments of Traders Report, notable changes include rising net positions in the USD index and the Swiss franc, and falling net positions in the Australian dollar and gold. Similar to last week, the only asset under our coverage that remains at an extreme is crude oil. The commodity is currently at a bullish extreme, based on trailing 36-month average net positions and looking at net positions as a proportion of total open interest.

The purpose of this weekly report is to track how the consensus is positioned across various major currencies and commodities. When net long positions become crowded in either direction, we flag extended positioning as a risk. Crowded positions do not suggest an imminent reversal, but should be considered as a significant risk factor when investing in the same direction as the crowd. This is shown below:

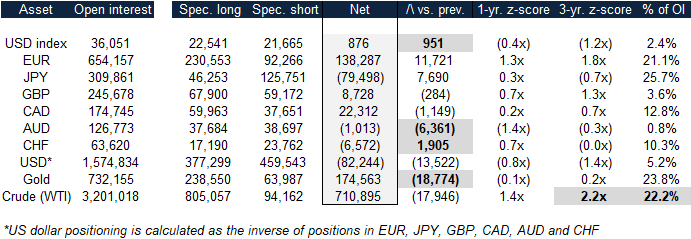

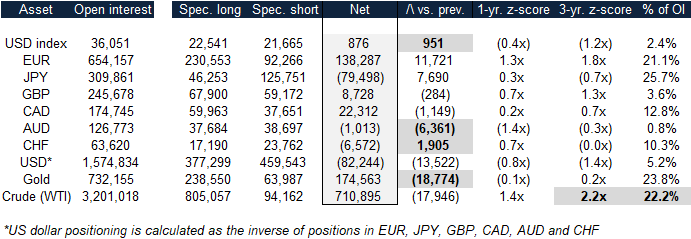

CFTC COT speculator positions (futures & options combined) – March 13, 2018

Source: CFTC, MarketsNow

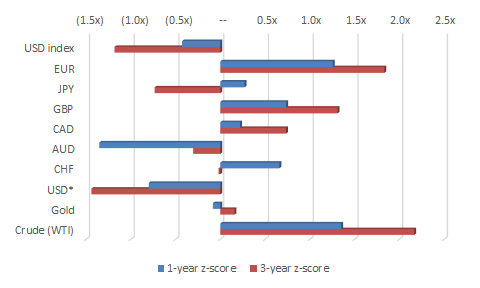

Notable extremes, significant changes in weekly positions, and large net positions as a proportion of open interest are highlighted above. Extremes in net positions are highlighted when speculator positioning is more than two standard deviations above trailing 1-year and 3-year averages. Weekly changes are highlighted when they are significant as a proportion of open interest. Finally, net positions as a proportion of outstanding interest are highlighted when they are large relative to historical averages. 1-year and 3-year z-scores are visually represented below:

1-year and 3-year z-scores based on net speculator positions

Source: CFTC, MarketsNow

Looking more closely at changes this week, net positions in safe havens (USD index, Swiss franc and the Japanese yen) are broadly higher. For the second week in a row, speculators have added long positions in the Swiss franc (+1,905 contracts). On the other hand, high-beta currencies and commodities such as the Australian dollar, Canadian dollar and crude oil are experiencing falling net positions. The most notable change is the outflow from Australian dollar positions this week (-6,361 contracts). As President Trump appears to be gearing up for a trade war aimed primarily at China, the Australian dollar has been selling off in response.

Leave A Comment