Photo Credit: Mike Mozart

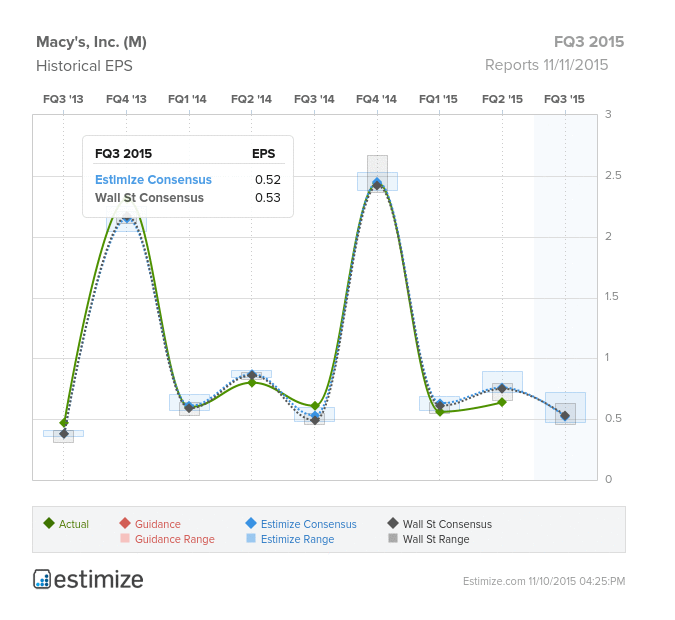

Macy’s Inc., one of America’s most popular department store chains, is set to report 3Q2015 earnings tomorrow before the market opens. The outlook is grim as analysts are predicting year over year declines in both EPS and revenue. The Estimize consensus, typically more bullish than Wall Street, is actually looking for numbers that are slightly below on Macy’s. Estimize is calling for EPS of $0.52 and revenue of $6.15 billion while Wall Street analysts are looking for EPS of $0.53 and revenue of $6.16 billion. Certain retail names have not done enough to attract customers this year, and it will be interesting to see if Macy’s reports its third consecutive quarter of negative earnings growth, and fourth consecutive EPS miss.

So, What’s Going On?

To make it black and white, the department store sector has been declining. Overall sales have fallen over the past five years by roughly 1.5 % and Macy’s has been sorely impacted. The Ohio based department chain has faced weak store traffic, which has caused a higher retention rate of inventory as sales continue to plummet. Sales for the previous two quarters were lower than expected, with the retail giant attributing difficulties to low international tourism spending because of the strong US dollar. Macy’s reported a sales decline of 2% last quarter while competitors Nordstrom and Dillard’s reported 4.9% and 1% same store sales growth figures, respectively. The individual stores scattered across the country have struggled as the company has announced the closing of around 35-40 locations, which would lead to a net loss of $300 million in revenue.

Furthermore, Citigroup slashed Macy’s price target as the firm forecasts a very difficult future for the department store sector. Shares fell by a little over 5% yesterday as a direct result. Macy’s has been focusing on new innovations to attempt to turn earnings in their favor.

Leave A Comment