The Dollar

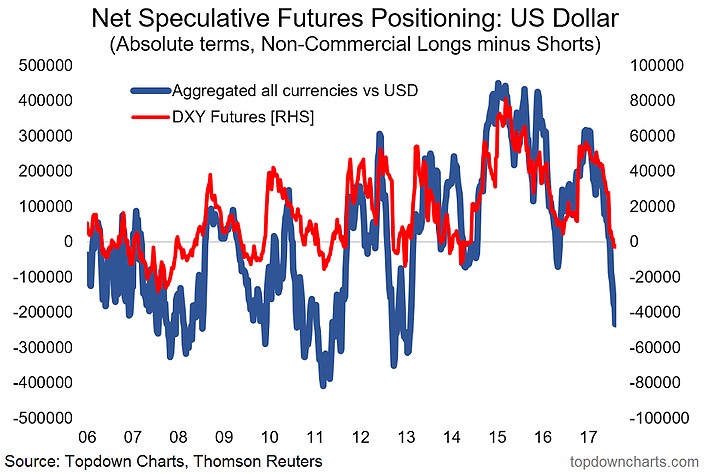

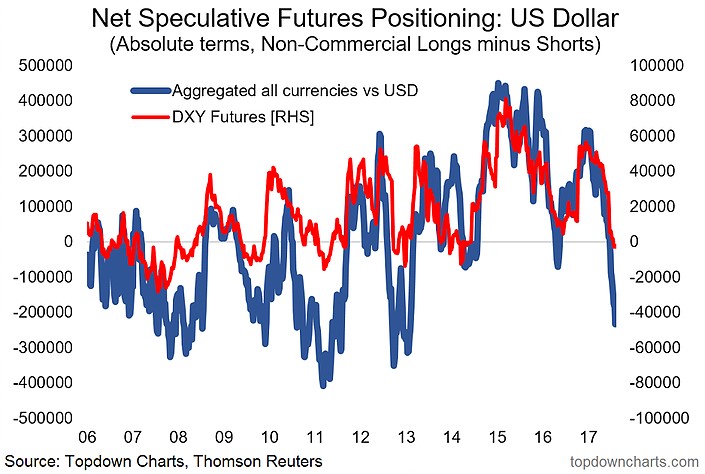

We don’t know for sure what caused the dollar’s weakness, but one aspect that is probably hurting the dollar is the accelerating growth in China, Japan, and Europe. Looking at future price performance, we must consider the possibility of a dollar rally. The chart below shows the speculative positioning in the dollar. When the positioning gets to the point where everyone is bearish, I get nervous because any news flowing the other way could cause a sharp reversal.

Looking at the catalysts for a dollar rally, I would say strong economic reports especially a GDP report with a 3 handle can help the dollar. Another catalyst for the dollar could be China pulling back on its infrastructure spending. The most obvious catalyst would be a smooth raising of the debt ceiling. Obviously, any positive American catalysts causing the dollar to rise would be good for stocks, while any negative factors for international countries would be bad for stocks. A final possibility would be the ECB not tapering as much as expected. That would be bullish for stocks and bullish for the dollar.

Macroeconomic News

Now let’s look at the economic news from this week. The first report we’ll look at is from the housing market. My stance on housing is some areas are expensive, but we aren’t in a real estate bubble like the 2000s. You can’t just look at a chart of home prices and compare the current market to the early 2000s. That would be like someone looking at the price of the Nasdaq and saying it’s going to crash like in 2001 again. Both of these predictions are being made. They are lazy because if you do your research, you will see technology earnings have improved and the housing market is no longer flooded with buyers who can’t afford the house they are looking to acquire. In the 2000s there were people with jobs making $70,000 per year trying to buy a second home. There were mortgages given without money down or proof of income. Anyone could get a house. This was the American nightmare because buying something you can’t afford will never work out.

Leave A Comment