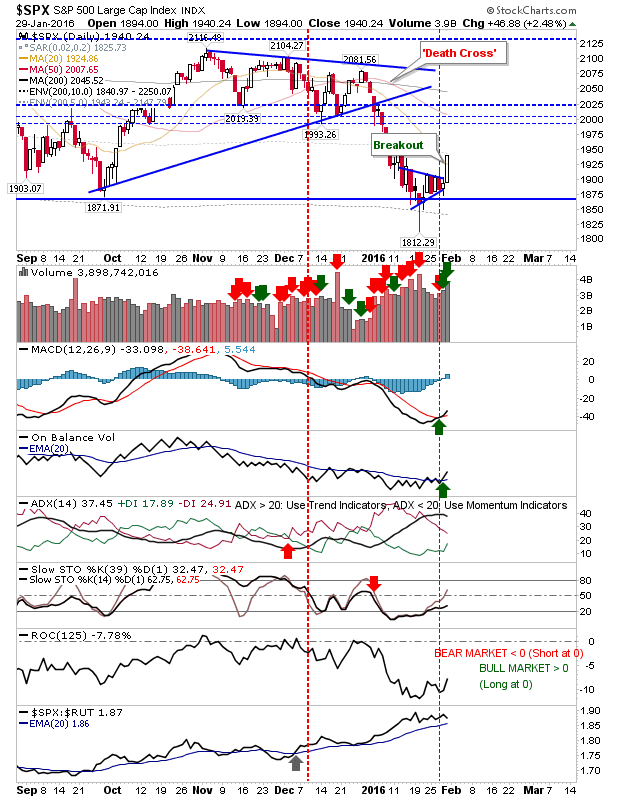

Markets were setting up for a push lower, but Friday’s upside break from consolidations triggered a wave of buying (and short covering). The buying was accompanied with higher volume accumulation. Shorts were left squealing by Friday’s action, and new shorts will need to wait until Nov-Dec consolidations are tested before new positions are entered. Until then, short covering and long buyers rule the day.

The S&P has taken the first step of a rally to take it back to the supply zone of 2,000. Friday’s action was accompanied by a MACD trigger ‘buy’ and On-Balance-Volume ‘buy’ trigger.

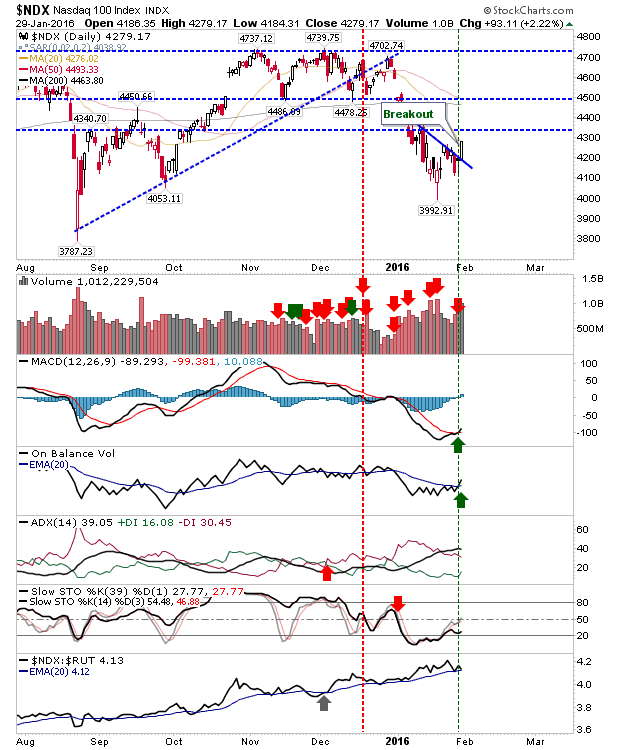

The Nasdaq cleared its consolidation. Next up is a move to the 50-day MA and then 4,900. Of the technical indicators, only the MACD trigger ‘buy’ was on record as a positive signal.

Nasdaq breadth improved sufficiently to generate a ‘buy’ signal, with all four metrics in oversold territory.

The Russell 2000 may have done enough to create a sizable ‘bear trap’. Of the indices, it has the greatest potential for upside. Note the relative performance ‘buy’ trigger against the Nasdaq (and watch for one against the S&P too). Pullback opportunities may offer chances to catch the next upside swing. The 50-day MA/declining wedge resistance is the first upside target.

As a final note, breakouts were also noted in the Dow, Nasdaq 100 and Semiconductor Index:

Leave A Comment