Written by Jeffrey Snider Alhambra

Goodnight Janet; Credit Follows The ‘Dollar’ Now

On this side of the “dollar” world, credit markets have all but written Janet Yellen into irrelevance. Despite her pleas (because of?) last week, there isn’t any part of money dealing or fixed income that is taking her “certainty” about recovery and “inflation” as even a partial setting. So lost is the FOMC, that everywhere you turn these markets are moving opposite.

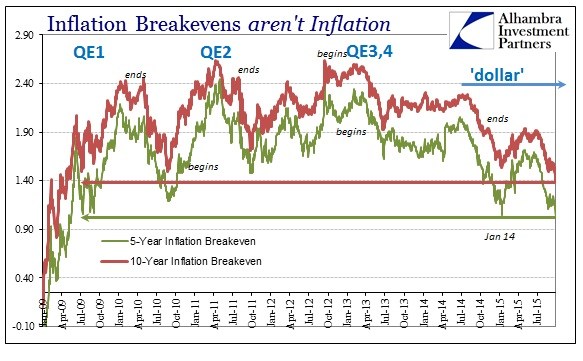

Where that has to sting the most is “inflation expectations.” Proving to be far more than just crude prices (which have largely been stable since August, at least in the view of not crashing again), breakevens are now at lows last seen in the dark days of 2009, surpassing that first “wave” earlier this year. Trading in the past few days has seen TIPS hedging interest drop sharply, which can only count as credit markets giving up on the recovery narrative in full – once (to January 14) might be “transitory”, but twice eight months later and at new lows is goodnight Yellen.

What really drives home that point is that the same new low has been visited in the FOMC’s “preferred” measure of forward inflation expectations, the 5-year/5-year forward rate. That measure (through yesterday’s liquidation) has dropped more than 10 bps just since Thursday’s close – when Yellen was last seen meekly projecting her “professional forecasters” of long-term expectations anchoring. This can only be interpreted as a directmarket rebuke.

As I noted at the outset, that “inflation” view is not so much oil prices as it is “dollar.” Funding markets, including the Asian “dollar” again, have grown especially bearish in the past week, really dating back to September 17 when the FOMC basically confirmed what money markets have been suggesting in this latest “dollar” wave. The eurodollar market, in particular, is flushing in a manner that looks very much like another run (or the continuation of the previous to August 24; separated only by a short intermission rather than any kind of retracing perceptions).

Leave A Comment