Yes, it’s the middle of the summer, and yes, volatility is extremely low! And, no, I’m not calling for a top here in stocks. But, what I am concerned is what the key averages (Dow Jones Industrial Average, S&P 500 Index and the Nasdaq Composite) are doing from a pure technical perspective.

Looking back at charts this past spring, while the Nasdaq Composite and technology stocks as a whole, were soaring to fresh all-time high after fresh all-time high. Both the Dow Jones Industrial Average and the S&P 500 Index, however, traded within their respective ranges until late May.

It was nearly two months of consolidation until all three (indices) begun to harmoniously hit record high prices. In other words, they (the Dow and S&P 500) lagged while the Nasdaq assumed leadership. Since then, however, it has been the Dow and S&P that have reaching a series of fresh record highs, while the Nasdaq has lagged behind, consolidating gains for roughly a month. That was until last week, that the Nasdaq broke-out to record highs only. The point is, that leadership has shifted from the tech-heavy Nasdaq to the more-balanced, Dow and S&P 500.

This may be another just throw caution in the wind moment, however, especially since the market universally has gone straight up since the 4th of July. But,there are two developments recently that merit some concern for stocks.

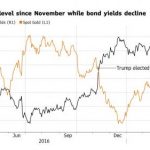

First, is the weak dollar trade, which has persisted all year, but is now finally peculating into strength in the Japanese yen and the price of Gold. Over the past week, both have rallied quite significantly, which is typically a hint of risk aversion, normally a bad sign for stock markets around the world. Therefore, if the price of gold were to ascend quickly towards the important 1300 handle, and the USD/JPY were to break key psychological support at the 110, equity indices would likely sell-off.

The second development, is Crude oil’s price reaction late last week. Typically, dollar weakness promotes high commodity prices, but in this case, late last week oil plummeted as the Dollar Index closed the week at fresh 52-week lows . To be fair, Crude oil, is trading firmly within a range, and is seemingly stable to start the week. That said, if Crude oil prices were to drop significantly this week, technical factors could dent sentiment in equity markets.

All in all, I am still maintaining my medium-term bullish outlook on equities and believe corrective pullbacks will continue to be shallow and rotational in nature. That said, it does worry me that leadership amongst stocks may be changing and that bull momentum may be slowing down. Most importantly, if stock market indices fail to make headway at this very juncture, this could signal a false-break scenario, a technical set-up that is often proceeded by a quick, but strong reversal lower.

Leave A Comment