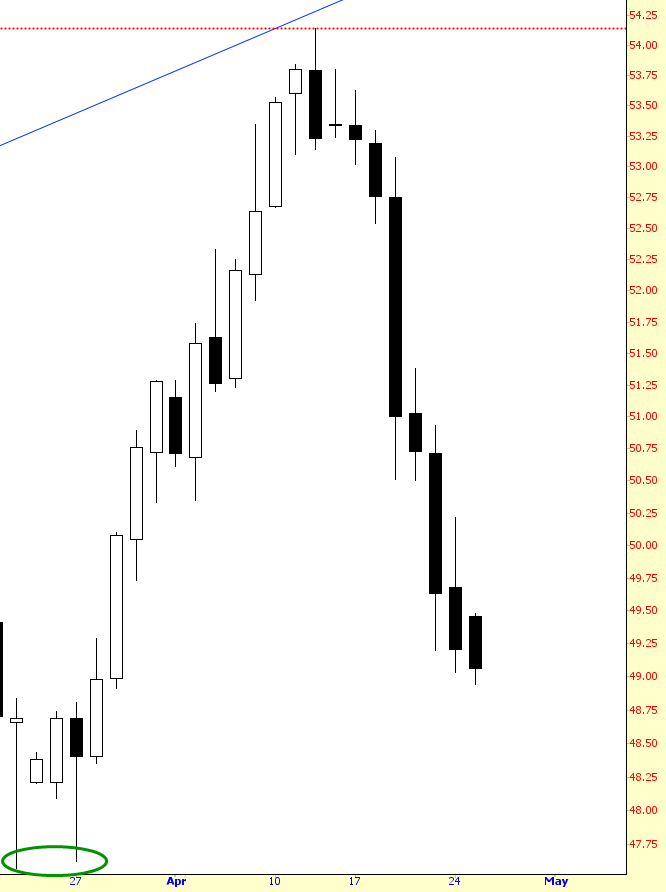

On April 11th, we got our rock-solid, never-fail signal to short the oil market. Since then, every single trading day – nine consecutive, as of this writing – have been black candlesticks, in spite of an (insane) mega-rally going on with other assets.

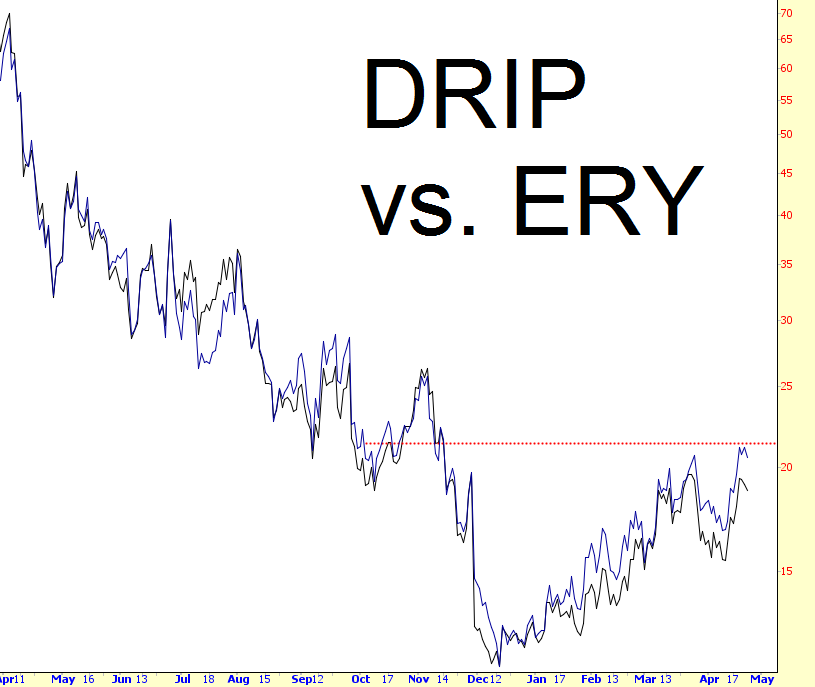

I think it was redvettes who brought my attention to the fact that besides the triple-bearish fund ERY (a favorite of mine, which I’ve written about often here on Slope), there was also a fund called DRIP which had broader coverage, less-focused on mega-caps like Exxon. I was wondering if I was making a mistake sticking with ERY, but as the overlay below shows, they’re pretty much the same creature, and ERY’s volume is about twice as good, so I think I’m just going to stick to that instrument.

Leave A Comment