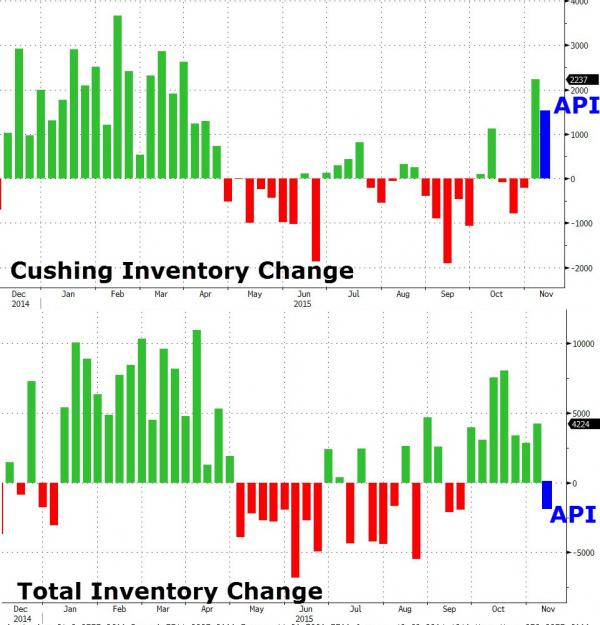

After seven straight weeks of significant inventory builds, API reported a modest 482k draw.That was all the algos needed and WTI immediately ramped back above $41.00. However, what they likely missed was the 2nd weekly (huge) build in Cushing (1.5mm barrels) as we warned earlier on land storage starting to really fill…

Cushing saw another big build…

And crude reacted…

we warned earlier on land storage starting to really fill…

In short: “The US is the last place with significant onshore crude storage space left.”

Which leads directly to Citi’s conclusion: “‘Sell the rally’ near-term as fundamentals remain very sloppy and inventory constraints are becoming increasingly more binding.”

Charts: Bloomberg

Leave A Comment