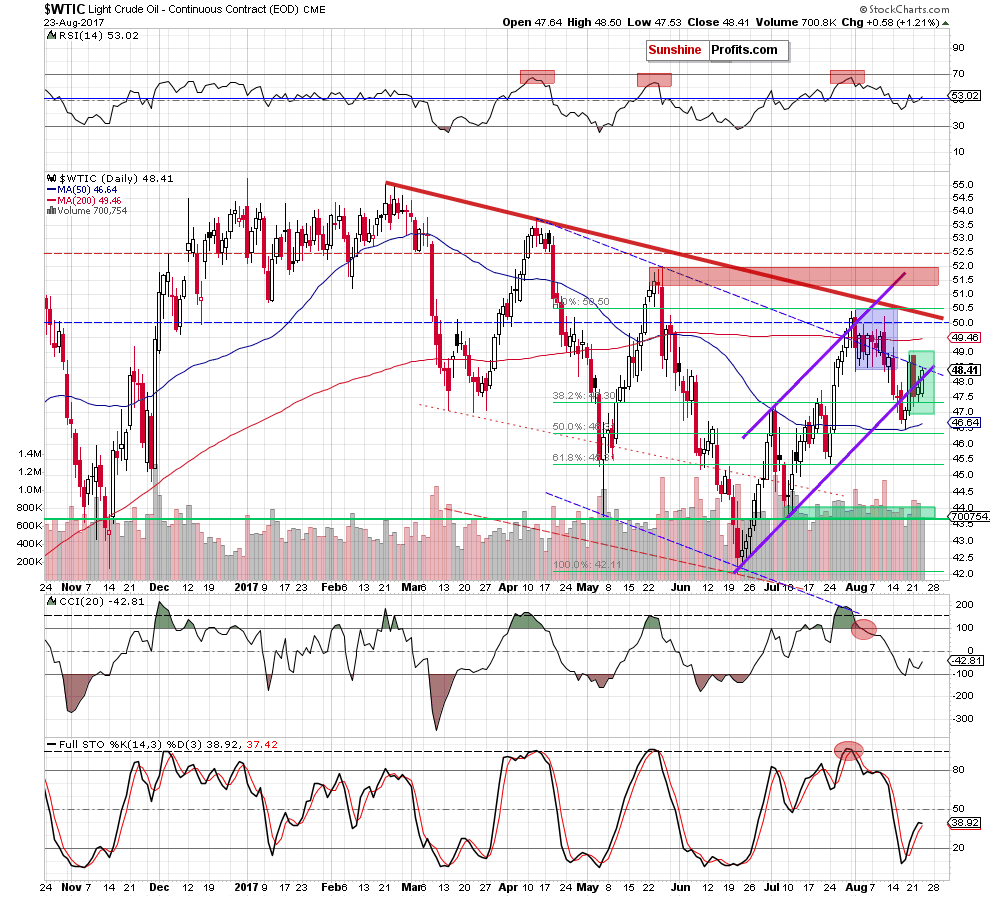

On Wednesday, light crude gained 1.21% after the EIA weekly report showed declines in crude oil and gasoline inventories. As a result, the black gold came back above the lower border of the trend channel, but can we trust this increase?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil extended Tuesday’s gains and climbed above the lower border of the purple rising trend channel, invalidating the earlier breakdown. But is this move as positive as it looks at the first sight?

In our opinion, it is not, because this is a repeat of what we already saw on Friday. Why? Although the commodity invalidated the breakdown, yesterday’s move materialized on smaller volume than earlier declines, which raises doubts about oil bulls’ strength once again. What’s interesting, the size of volume, which accompanied Wednesday’s increase, was even smaller than what we saw on Friday. This suggests that we’ll likely see another downswing and a breakdown under the lower line of the trend channel in the very near future (maybe even later in the day).

Additionally, the black gold remains in the green consolidation, which suggests that the breakdown below the lower border of the formation will result not only in a test of the recent lows, but also will open the way to lower levels.

How low could the commodity go in the coming days?

We believe that the best answer to this question will be the quote from our yesterday’s Oil Trading Alert:

(…) In our opinion, if crude oil declines from current levels, the first downside target will be the recent low, the 50-day moving average and the 50% Fibonacci retracement (around $46.32-$46.60). However, if this support area is broken, we’ll see further deterioration and a test of the late July low of $45.40 and the 61.8% Fibonacci retracement in the following day(s).

Leave A Comment