On Thursday crude oil wavered between small gains and losses, but finished the day only 23 cents above Wednesday closing price. Such small daily changes that we observe recently don’t look too encouraging for oil bulls or for the bears. However, to dispel boredom, we rummaged deeper in the charts and we found something that may interest both sides of the market’s battle. Curious?

Nevertheless, before we get to our little surprise, we would like to draw your attention to news from the IEA. Yesterday, the International Energy Agency said that global oil supply increased by 700,000 barrels per day from a year ago in the previous month. Additionally, we find out that supplies from producers outside of the OPEC will grow by 1.8 million bpd this year versus an increase of 760,000 bpd last year (mainly due to the rapidly growing production in the U.S.).

Such information (especially in connection with the previous reports from this month about which you could read in our March alerts) doesn’t bode too well for higher prices, increasing worries that rising supply from the U.S. and other nations could spoil efforts made by OPEC and other producers to tighten the market.

Is the fundamental picture of crude oil the only one who suggest that the lower prices are just around the corner? Let’s take a closer look at the charts below to find out (charts courtesy of StockCharts).

Technical Analysis of Crude Oil

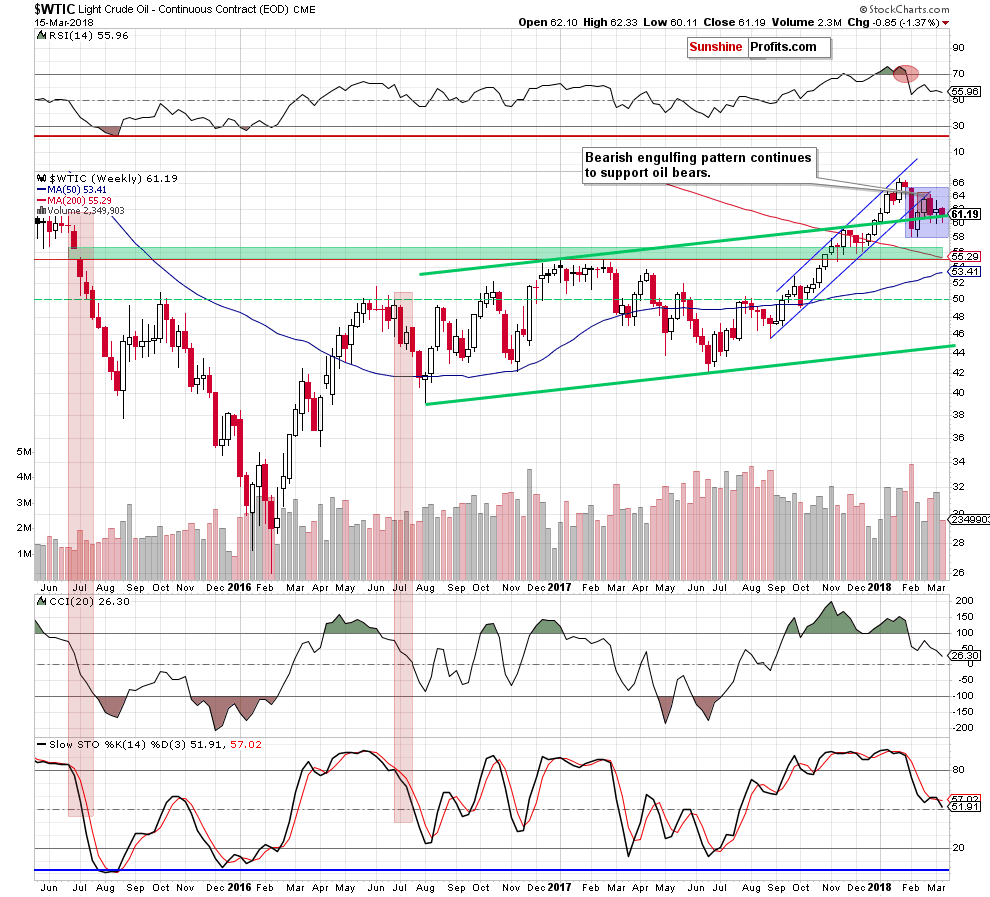

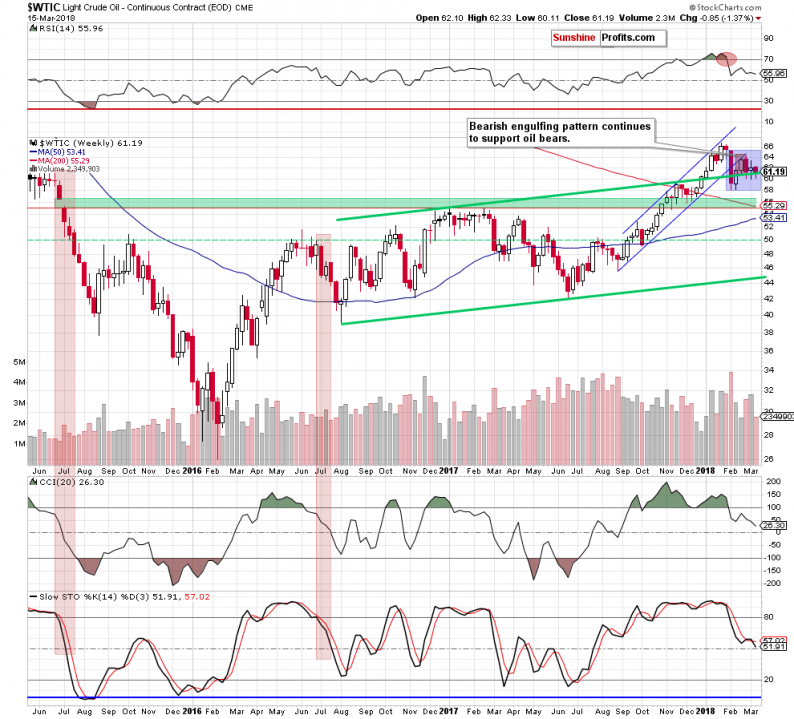

Looking at the medium-term picture of the commodity, we see that the situation remains almost unchanged as the previously-broken upper border of the green rising trend channel continues to keep declines in check. Additionally, black gold is still trading in the blue consolidation, which raises the importance of this area for both sides of the market.

Nevertheless, the sell signals generated by all indicators remain in the cards, supporting the sellers as well as the bearish engulfing pattern, which strengthens the blockade of the road to the north.

So, if the medium-term picture may raise some doubts about the direction of the next bigger movement, is it possible that the short-term changes give us credible hints about the future of crude oil? Let’s check it.

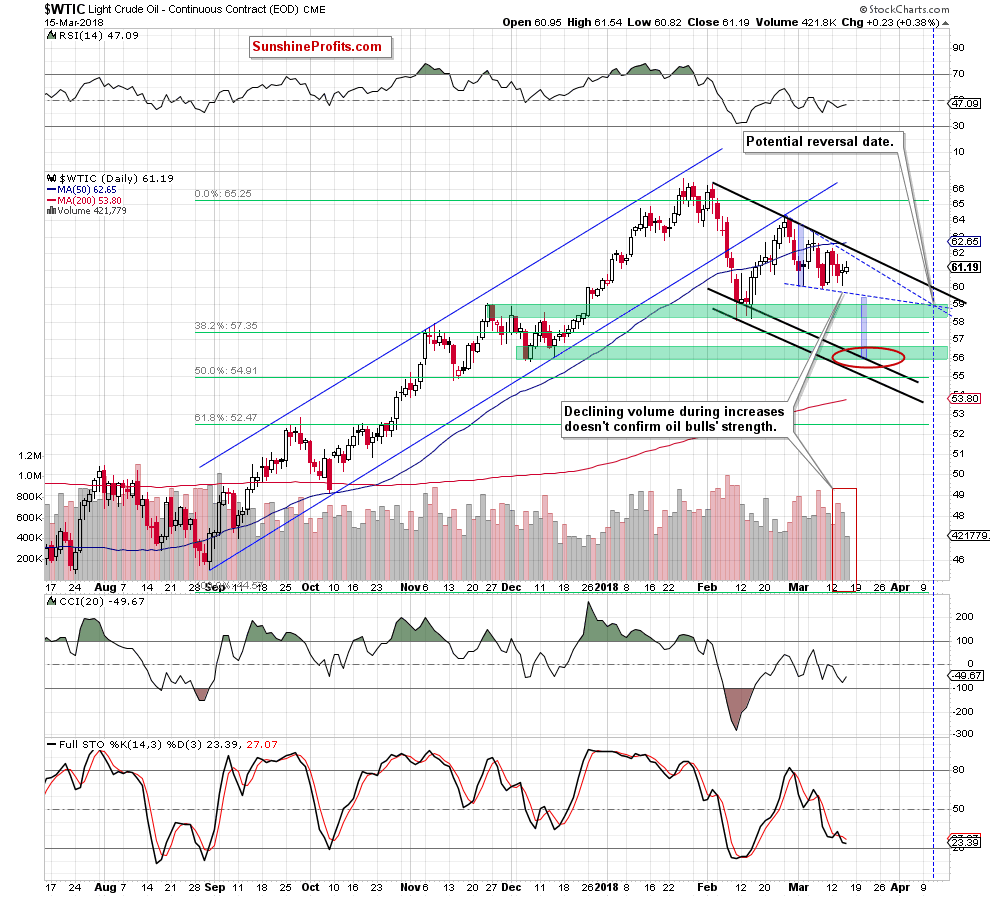

At the first glance, we could write that the situation doesn’t look much better from this perspective, because crude oil still remains in a very short-term consolidation between the barrier of $60 and the black declining resistance line based on the previous highs (a potential upper border of declining trend channel), which is currently reinforced by the previously-broken 50-day moving average.

Leave A Comment