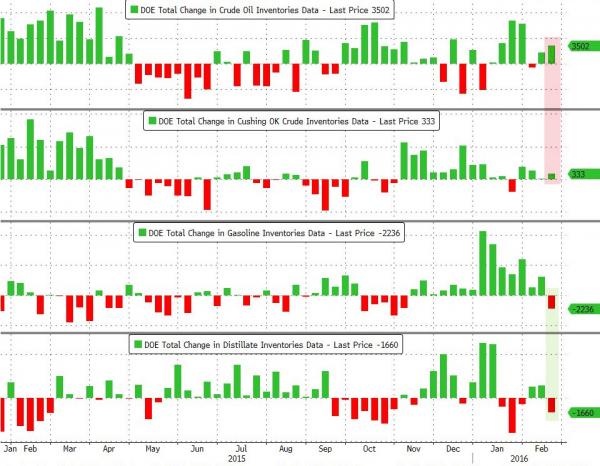

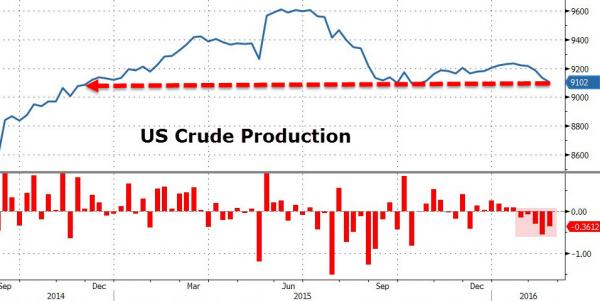

Following last night’s major build (from API), DOE reported a bigger than expected Crude build (3.5mm vs 3.25 exp). Crude prices jerked higher on this news as it was less than the API print of +7.1mm build and Gasoline and Distillates inventories dropped. However, Cushing inventories rose 333k barrels (the 15th build in the last 16 weeks. Perhaps more importantly, The Lower 48 saw a 196k bbl/day YoY drop in production (the 5th weekly drop in a row) and oil prices are surging.

API:

DOE:

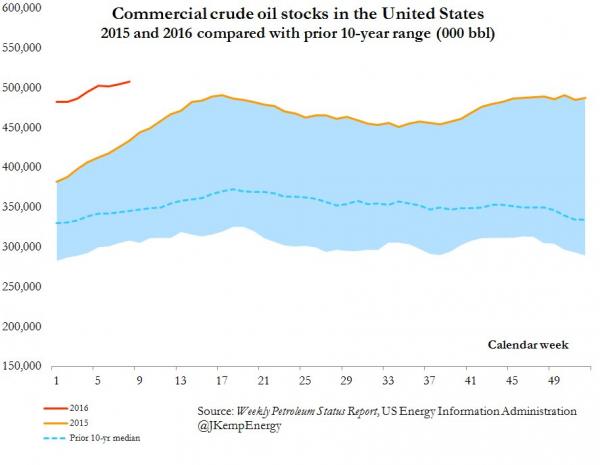

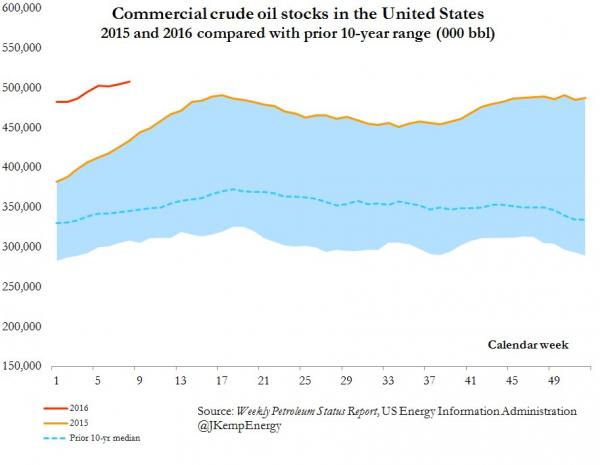

The all important commercial stocks rose by 3.5 million to another record high of 507.6MM, 73.5MM barrels, or 16.9%, higher than a year ago.

The full breakdown: first drop in gasoline inventories in 15 weeks

So overall crude inevntory was less than API (but API just caught up t last week’s miss) and was more than expected. Cushing saw another build – which is a major problem as we already noted that it is denying storage requests.

But the 5th weekly drop in production has encouraged some more buying… with production down 196k bbl/day YoY

The reaction is a knee-jerk spike (for now)…

Charts: Bloomberg

Leave A Comment