With global markets in a sea of red and US Treasury rates close to three-month highs on Friday, Asian markets began the potentially volatile month warily as investors awaited U.S. payroll data, even though a rate cut is widely expected next week. Ahead of Tuesday’s U.S. presidential election and the Federal Reserve’s policy meeting the following day, investors await Friday’s nonfarm payrolls report. Following a sell-off overnight, Amazon’s 5.3% post-bell rally, which increased its market capitalisation by $104 billion, helped Nasdaq futures recover modestly After the close, the beleaguered Intel’s shares rose 7% as a result of its unexpectedly optimistic revenue forecasts. With a 0.3% decline, MSCI’s broadest index of Asia-Pacific stocks outside of Japan fell 1.9% for the week. A higher yen clouded the outlook for Japanese exporters, causing Tokyo’s Nikkei to drop 2.1%. Hong Kong’s Hang Seng index increased and China’s blue chips crept up after data revealed that factory activity in China resumed expanding in October. Despite both firms exceeding earnings projections, shares of Microsoft and Facebook’s parent company Meta Platforms dropped 6% and 4% overnight as investors feared that rising artificial intelligence will reduce their earnings. Since data indicated that U.S. consumption remained strong and inflation indicators indicated that price pressures were abating, a quarter-point rate drop by the Fed is 94% priced in, barring a significant surprise in the U.S. payrolls report. As a result of claims that Iran is preparing to launch a retaliation strike on Israel from Iraqi territory in the coming days, oil prices continued their upward trend, with Brent prices rising over 2% to $74.13 per barrel.Investors will be closely monitoring whether UK government bonds (gilts) continue their sell-off and if the pound breaks its 200-day moving average, as markets assess Chancellor Rachel Reeves’ debut budget. Investors fear the budget’s emphasis on spending could put upward pressure on inflation, leading investors to bet that the Bank of England may need to slow the pace of future rate hikes. Two-year gilt yields have surged 27 basis points this week, though this pales in comparison to the 89-basis-point rout following Liz Truss’ 2022 effort.In the U.S., earnings reports from Exxon Mobil and Chevron, along with the high-profile ISM manufacturing survey and the non-farm payrolls report, are on the agenda. Hurricanes and strikes have made it challenging to interpret the jobs data. Forecasts centre on a rise of 113,000 new jobs in October, but a strong ADP report and lower jobless claims data suggest the risks are skewed to the upside. The unemployment rate is likely to have remained at 4.1%, so barring a major surprise, markets will likely maintain their bets that the Federal Reserve will cut rates by a quarter-point next Wednesday.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

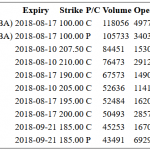

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 25/10/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5775

EURUSD Bullish Above Bearish Below 1.09

EURUSD Bullish Above Bearish Below 1.09

GBPUSD Bullish Above Bearish Below 1.3050

GBPUSD Bullish Above Bearish Below 1.3050

USDJPY Bullish Above Bearish Below 148

USDJPY Bullish Above Bearish Below 148

XAUUSD Bullish Above Bearish Below 2680

XAUUSD Bullish Above Bearish Below 2680

BTCUSD Bullish Above Bearish Below 69500

BTCUSD Bullish Above Bearish Below 69500

More By This Author:FTSE Ending The Month In The Red, Investors Vote With Their Feet On UK Budget

More By This Author:FTSE Ending The Month In The Red, Investors Vote With Their Feet On UK Budget

Dow Jones Multi Time Frame Trade Setup

Daily Market Outlook – Thursday, Oct. 31

Leave A Comment