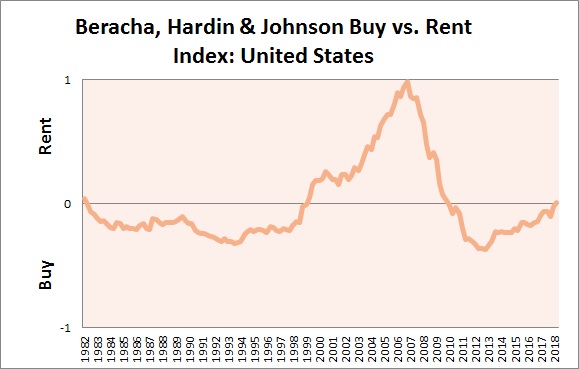

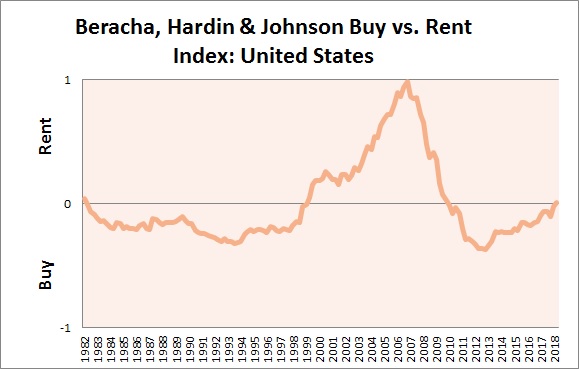

Florida Atlantic University and Florida International University co-create a “buy versus rent” scoring system called the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index. Last month, this index crossed a critical threshold for the first time since 2010: U.S. households are once again better off renting than buying. This cross-over provides further confirmation of the worsening affordability issues I have recently chronicled in my monthly Housing Market Reviews.

The rent/buy decision for housing tipped to rent for the first time since 2010.

From the August, 2018 summary post:

“It is clear that we are at a point where markets will begin to see downward pricing pressure, implying in some markets annual pricing increases will begin to slow…U.S. housing markets are clearly heading toward the peak of the current cycle.”

The good news is that the transition from peak to pullback should be a lot smoother than the bursting of the historic housing bubble from the last cycle. During that time, speculative fever and fraudulent mortgages artificially drove demand and prices sky-high and also motivated builders to help produce a glut of housing supply. Currently, housing supply is very tight as cautious builders tightly control their operations and existing homeowners choose to hold onto their homes. Moreover, mortgage-holders tend to have solid credit ratings, and the overall economy is still strong.

The above chart also shows that, at an aggregate basis, the economics of housing can favor renting over buying for many years before macro-economic trouble erupts. The duration is likely related to the inclusion of an investment component on the rent side. I strongly suspect few households use this kind of investment strategy (for example, in 2017 only 52% of Americans said they were invested in stocks and that percentage has been in decline). The difference between owning and renting must be invested in a diversified portfolio of stocks and bonds. When the BH&J Buy vs. Rent Index last crossed from favoring buying to renting in 1999, a correction in housing prices was felt most sharply in a few over-heated markets. The index did not even reverse until reaching its bubble-driven extreme in 2007.

Leave A Comment