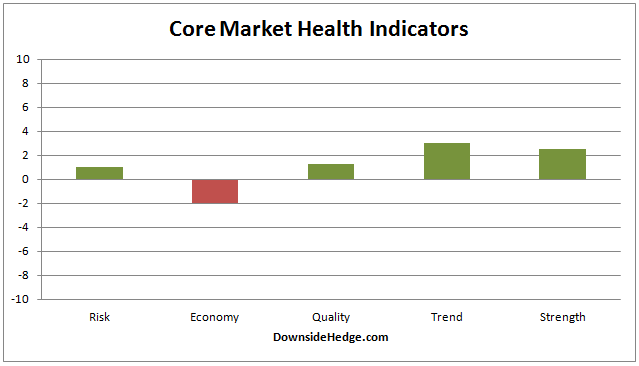

Over the past week, my core market health indicators collapsed. They are all moving quickly toward zero. Most notably, is my core measures of risk. They are very close to going negative.

In addition to my core measures, breadth measures are starting to warn as well. The bullish percent index (BPSPX), which tracks the percent of stocks in the S&P 500 Index (SPX) that have bullish point and figure charts, has fallen below 60%. When this occurs the odds of a 10% decline (from current levels) increases substantially. Especially if my market risk indicator signals. Currently, two of four components of that indicator are warning. However, the other two are a long way away from a signal. I suspect it would take a quick fall through 2100 on SPX to create a warning.

Another breadth indicator that is warning is the percent of stocks in SPX that are below their 200 day moving average. It is also below 60%.

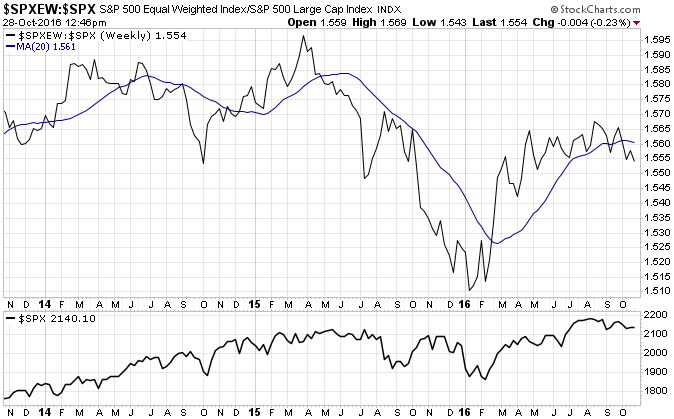

I’m sure you’ve all noticed that small cap stocks have broken down lately. This signals that investors are taking risk off the table. Another sign that investors are becoming risk averse comes from the ratio between the S&P 500 Equal Weight Index (SPXEW) and SPX. It has once again fallen below its 20 week moving average. This indicates that investors are moving to mega cap stocks from big cap stocks. This is often a flight to quality.

Conclusion

Risk of a 10% decline from current levels is rising. Breadth is showing weakness and investors are moving to safety. We don’t have a market risk warning yet, but with risk rising it’s time to start watching the market closely.

Leave A Comment