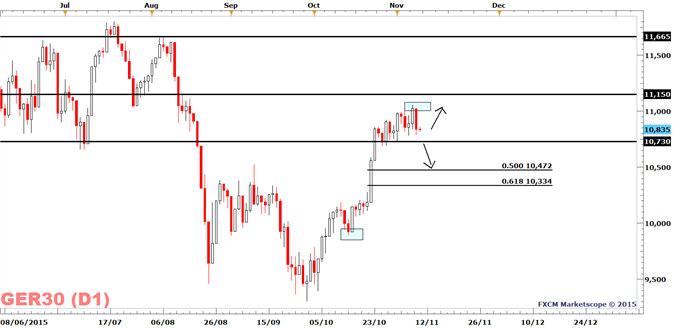

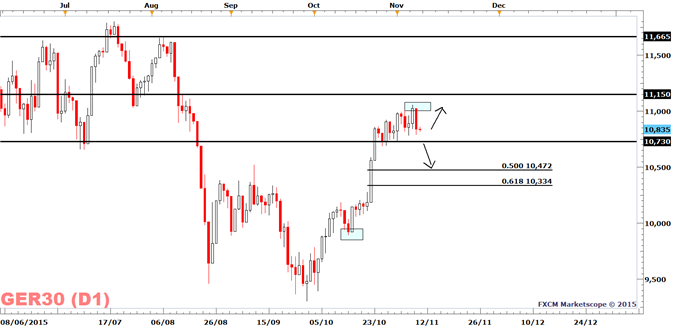

The DAX 30 has managed to recuperate some of yesterday’s losses. Given that we are still trading above the 10,770 support level, the DAX index may bounce back to the 11k mark.

However, if the DAX 30 breaks below 10,770, the index may breach the November 2 low of 10,730, a stronger and more important support level. In the case that we breach this level, we may see a steeper pullback taking the DAX 30 to 10,472 which is a 50% correction of the 9884 – 11,057 rally.

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

Yesterday, the DAX index slipped 2%. The declines in the cash market were broad and with no gaining sectors. The only major change noted during the session was the rather more ‘hawkish’ than expected comments from the Chicago Fed’s CEO, Charles L. Evans.

He came out stating that he is not “predisposed against a December liftoff”, whilst also saying “the FOMC has gotten closer to lift off”. This boosted expectations of a Fed rate hike, which could justify the slide in the DAX index. Traditionally, the stock markets tends to soften on the first rate hike.

Today U.S. NFIB Small Business Optimism is on tap. The index is like an ISM or PMI indicator but for small businesses and is expected to print 96.4 according to a Bloomberg News Survey. The index itself has been increasing since June 2015 and we don’t place much emphasis on it but as the DAX is near support it may trigger a bounce in the DAX or a break of the bullish uptrend. U.S. Wholesale Inventories is also on tap and expected to rise by 0.1% MoM.

Leave A Comment