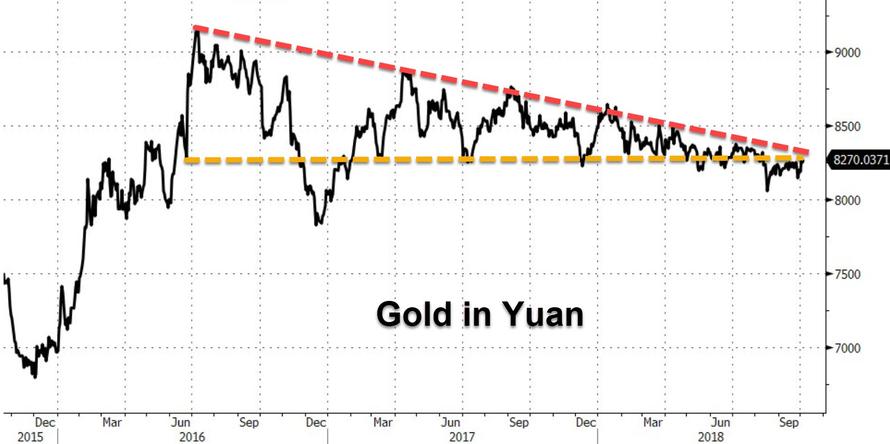

China remains closed for Golden Week, but Offshore Yuan broke significant support and is pushing back down to its cycle lows…

And Gold in Yuan bounced back to its relatively stable levels…

We warned yesterday (courtesy of Bloomberg’s Cameron Crise) that the velocity of the bond yield spike was not the friend of stocks… this yield move is entering the “danger zone” for stocks. The 30bps spike in the last 5 weeks falls into the cohort where average and median equity performance has been negative over the following five weeks. Do with that information what you will, but realize that with this kind of price action the bond market is not the equity market’s friend.

And sure enough – it wasn’t…Nasdaq was the day’s worst performer…Selling really escalated when Europe closed…

But Small Caps remain worst on the week…

Nasdaq broke down below its 50DMA…

VIX broke above 15.50 intraday…

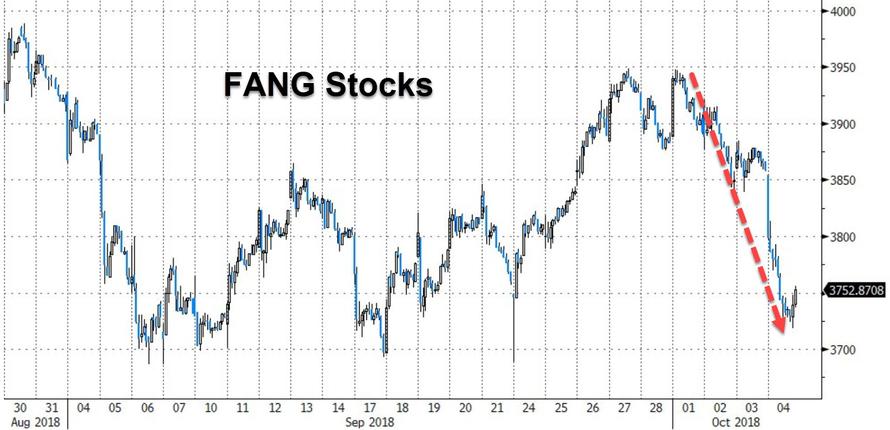

FANGs were proper f***ed…

All the FANGs are down hard this week…

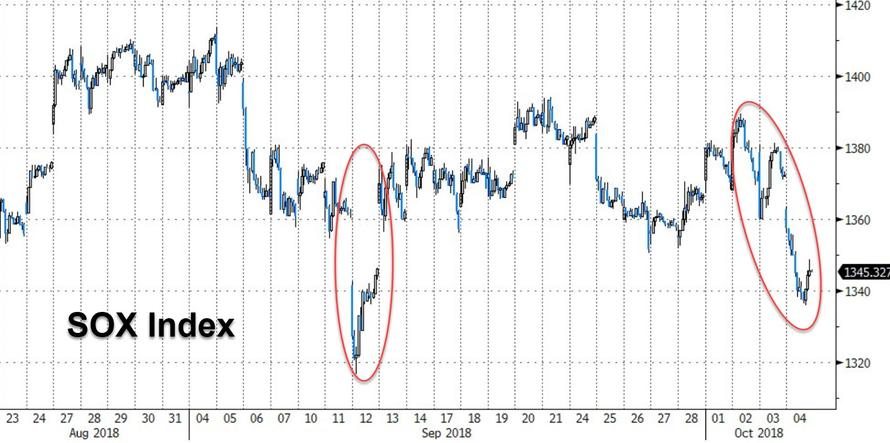

Semis were slammed on the China spying allegations…

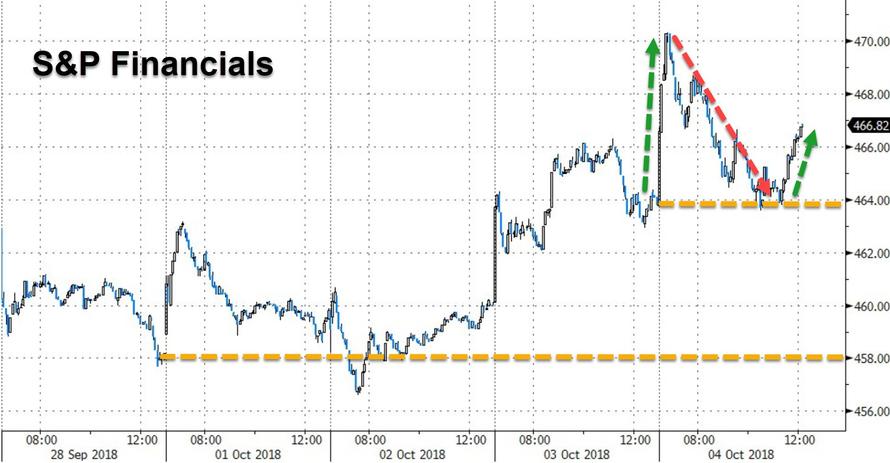

Financials started the day off well but rapidly gave it all back before a late bounce…

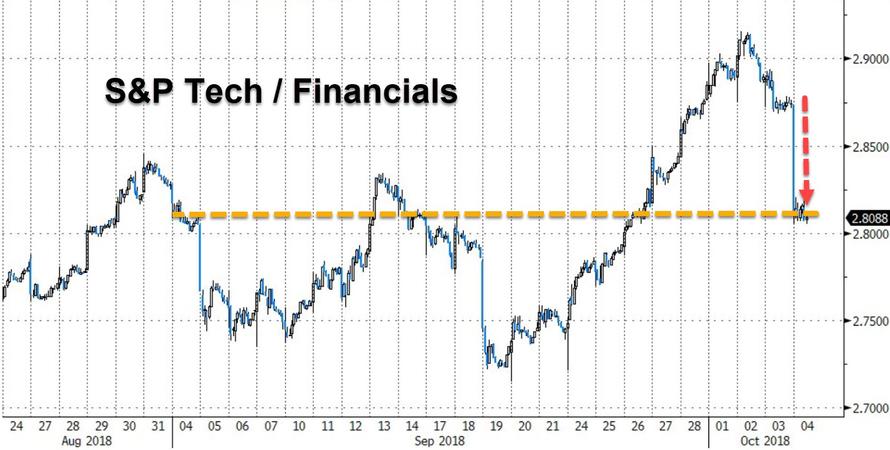

But financials erased all of Tech’s relative outperformance from September…

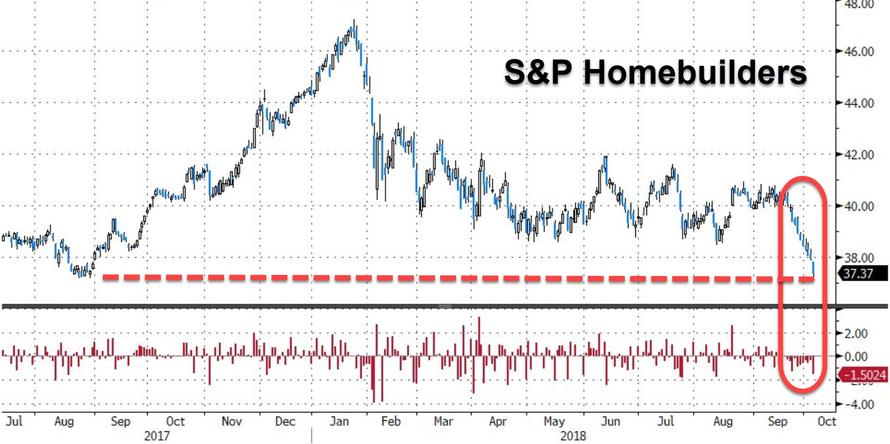

Homebuilder stocks are down 12 days in a row…

Hedge funds are back to their weakest level in 10 months…

High yield bond ETF prices plunged…

After yesterday’s ugliness in the bond market, today was sideways trading (higher in yield) as the pain was transmitted to stocks via RP strategies…

10Y ended the day higher in yield but well off the highs…

The Dollar rallied after the close last night on hawkish Powell headlines then dumped back into the red during the European day… rallying back into the green once Europe closed…

Leave A Comment