We’ve spent a lot of time talking about inequality in these pages.

This discussion is particularly relevant now for two reasons.

Taking those in turn, the policy response to the financial crisis served to inflate the value of financial assets and those assets are disproportionately concentrated in the hands of the wealthy. One of the most important things to understand about this dynamic is that it’s not linear. Here’s how Salient’s Ben Hunt described the situation in a recent note called “The Pecking Order“:

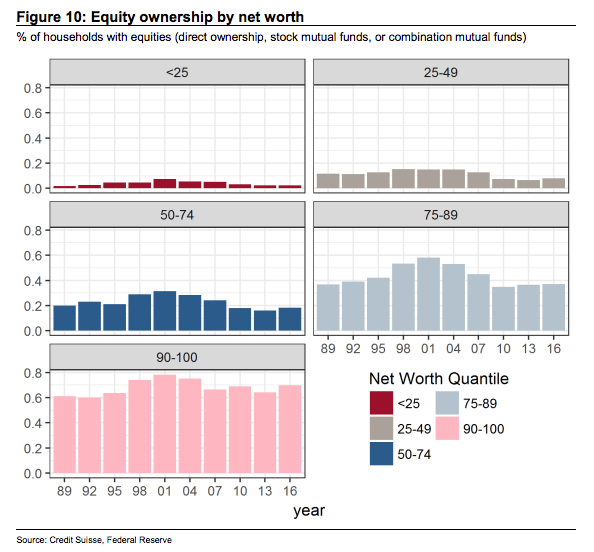

The goodies of a trebled stock market aren’t evenly distributed. Who owns stocks? If we’re talking about households, leaving aside pension funds and endowments and other institutional investors, it’s the rich, mostly. And that household share of the Central Bankers’ Bubble doesn’t increase linearly with wealth, but exponentially, meaning that the really rich own a lot more stocks than the merely rich, so the really rich have gotten a lot richer than the merely rich.

So to the extent investors have seen their E*Trade accounts and 401(k)s inflate on the back of nine years of central bank profligacy, it’s important that those folks understand that while they are richer in an absolute sense, they are poorer in relative terms almost by definition.

Of course that assumes you actually own stocks. And as we’ve shown time and again, that is not a safe assumption for large swaths of the American electorate. Here’s the breakdown by net worth:

And here’s the chart from the GAO that lends the lie to Trump’s “how’s your 401(k)?” bullshit (that’s a slogan he’s now testing out at rallies):

Leave A Comment