This isn’t going to get any easier on the FX front for Mario Draghi unless people start taking Mnuchin and Trump seriously about not trying to drive the dollar lower.

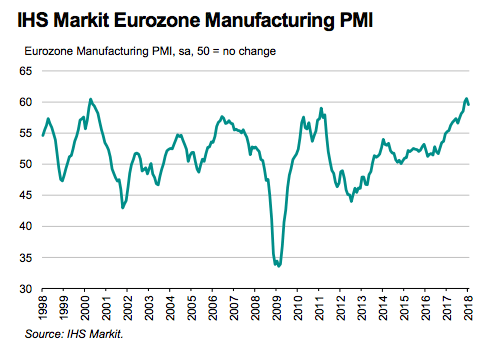

The data on Thursday was great with the Eurozone January Manufacturing PMI printing at 59.6 (flash was also 59.6), marking one of the best showings ever for the opening month to a year.

And there were signs of inflation. Here’s Markit:

Inflationary pressures picked up at the start of 2018, with both output charges and input prices rising at faster rates. Output price inflation accelerated to an 80-month high. Purchasing costs rose to the greatest extent in over six-and-a-half years, reflecting higher commodity prices (including oil) and greater pricing power at vendors. The latter factor was the result of shortages developing for some inputs as demand outstripped supply. This also led to one of the sharpest lengthening of supplier lead times on record.

“The hike in prices associated with the further shift to a sellers’ market for many goods was accompanied by a steep rising in oil prices during the month, resulting in a further intensification of cost pressures,” Chris Williamson, Chief Business Economist at IHS Markit said, before warning that “with higher costs being increasingly passed on to customers, the survey sends a warning signal for a potential rise in future consumer price inflation.”

Right. And that, in turn, sends a signal to markets that the ECB hawks will have more ammunition despite what everyone is being forced to say publicly after last week’s Mnuchin boondoggle.

The euro has moved sideways (generally speaking) since CNBC leaked the “strong dollar” soundbites from Trump’s interview last Thursday afternoon, but you can see when the PMIs hit:

For bunds, this is just another reason to be bearish. “European bonds’ bad day just got worse [as] euro-area manufacturing PMI reports were not only better-than-expected for the most part, but the details also contain solid evidence of inflationary pressures,” Bloomberg’s Kristine Aquino writes.

Leave A Comment