A recent Wall Street Journal story stated that “A flattening of the Treasury yield curve in 2017 is a worrying sign for investors banking on resurgent U.S. inflation and growth.”

Hedgeye responded REALLY?! Wall Street Journal: “A Worrying Sign on US Inflation & Growth”

Let’s investigate starting with Hedgeye.

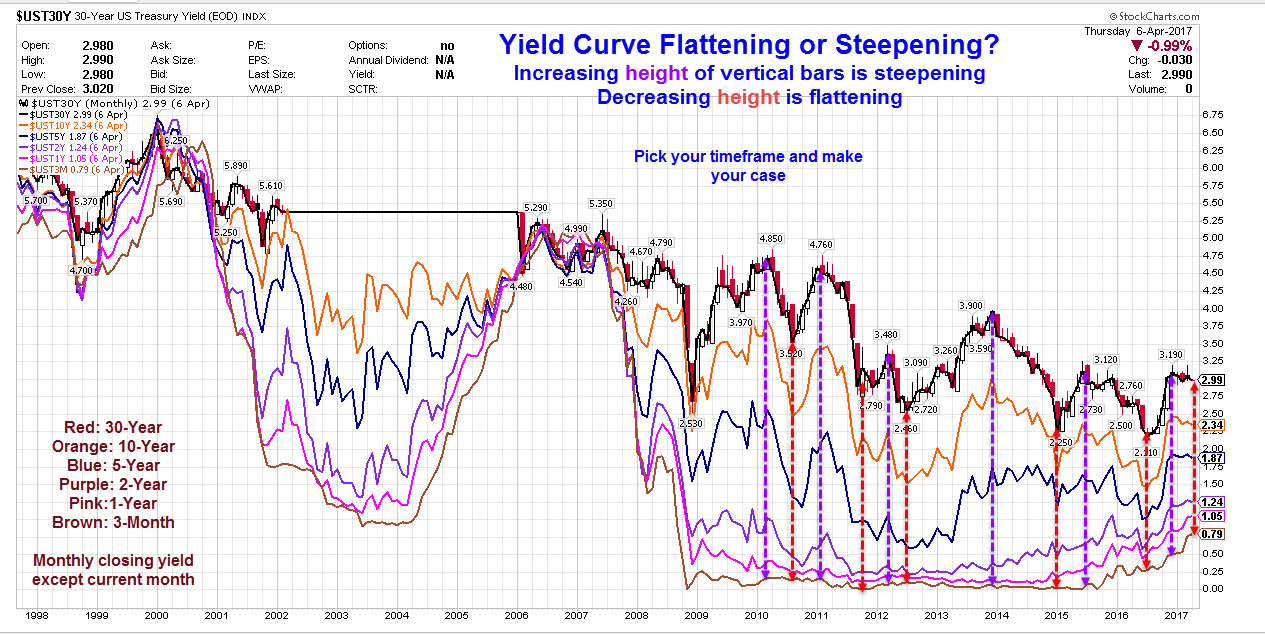

Yield Curve Discussion

For starters, “i.e.” is latin for “id est” and means roughly “that is” while “e.g.” stands for “exempli gratia” which means “for example.”

The reference “i.e” is flat out wrong. The yield curve does not equate to the 10-year yield minus the 2-year yield or any other spread, but rather the overall curve of interest rates from overnight to 30-years.

The Hedgeye example pertains to the steepness of a portion of the curve, specifically the 2-10 spread, for a select period of time hand-picked to show steepening.

Let’s investigate other time periods and other spreads.

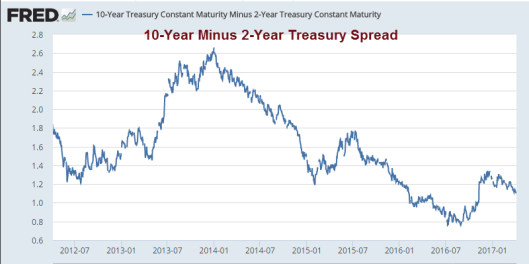

10-Year Minus 2-year

Is the spread steepening or flattening? The answer depends on your timeframe, but one would have to pick very peculiarly to conclusively say “up”.

10-Year Minus 3-Month

Is the spread steepening or flattening? The answer depends on your timeframe, but one would have to pick very peculiarly to conclusively say “up”.

30-Year Minus 3-Month

Is the spread steepening or flattening? The answer depends on your timeframe, but one would have to pick very peculiarly to conclusively say “up”.

Yield Curve Steepening or Flattening?

You can pick a time-frame and make nearly any claim you want. But what really makes sense?

Looking for Steepening? Here You Go!

Based on the allegedly steeping yield curve, Hedgeye made this statement: “As we’ve been saying for some time now, U.S. economic growth is accelerating. Expect the yield curve to continue to steepen, despite the false narratives being passed around bears.”

Leave A Comment