Ok, I don’t know how much figurative “stock” you put in Mitch McConnell’s Monday promise that there is “zero chance” of Congress not raising the debt ceiling by late September, but it’s at least plausible to suggest that however vacuous, the Senate Majority Leader’s comment helped buoy risk assets (i.e. literal stocks) on Tuesday.

Taken together with the Politico article that posited some progress on tax reform, investors may have gone into the cash open feeling a little better about the fiscal situation than they did at the end of last week.

Nevertheless, you can’t blame markets for being nervous. And no matter which side of the partisan divide you fall on, it’s impossible to argue that Donald Trump’s erratic behavior hasn’t made the situation even more ambiguous than it already would have been.

In previous posts, we’ve detailed how the VIX behaved during previous debt ceiling debacles and we’ve also documented how stocks reacted to the 2013 government shutdown.

Well on Tuesday, Deutsche Bank is out with a lengthy piece on what the implications are for fiscal policy, Fed policy and foreign flows.

Needless to say, all of that matters quite a lot for the dollar, which has been on the back foot for most of this year, a cruel twist of fate considering “long USD” was one of the “no-brainer” trades headed into 2017.

First on fiscal policy, Deutsche notes the following:

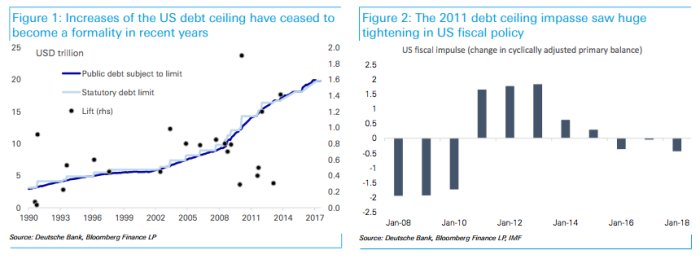

In August 2011, the price President Obama paid for the deal with House Republicans was multiple rounds of spending cuts (the Budget Control Act) with automatic sequestration (the fiscal cliff) if a bi-partisan super-committee failed to find a trillion dollars of additional cuts by November 2012. Combined with funding compromises agreed earlier in the year, this sharply reversed post-crisis stimulus. The US fiscal impulse flipped from an expansionary +2% GDP in 2010 to -1.5% in 2011 (chart 2).

By the October 2013 debt ceiling crisis, with lawmakers having failed to agree on a budget from the previous year, automatic spending cuts had already begun to come into effect. But with House Republicans still unwilling to fund the government without a delay to implementing the Affordable Care Act, the federal government went into partial shutdown. The immediate economic cost of the shutdown was calculated at 0.3 percent of GDP by the Bureau of Economic Analysis. But the backlash ultimately pressured Republican lawmakers into a series of temporary resolutions funding the government over the next three years.

Leave A Comment