There is a range of factors which drive the Kondratiev waves. Following Schumpeter, we have focused so far on technological innovations. However, debt cycles are also a key. What are they?

The debt cycles are comprised of alternate leveraging and deleveraging of debt. The former occurs when people incur debt, increasing the debt-to-income ratio, or the debt-to-assets ratio. The latter is the opposite, so it means paying back the debts, which leads to the decrease in the amount of debt relative to wages or assets.

Thanks to leveraging, economic units can increase their spending and magnify profits when the returns from the asset more than offset the costs of borrowing. This is why increasing debt load may temporarily boost economic growth. However, at some point debt servicing costs become too much relative to income. When the debt level reaches a saturation point, the deleveraging begins, and GDP growth slows down.

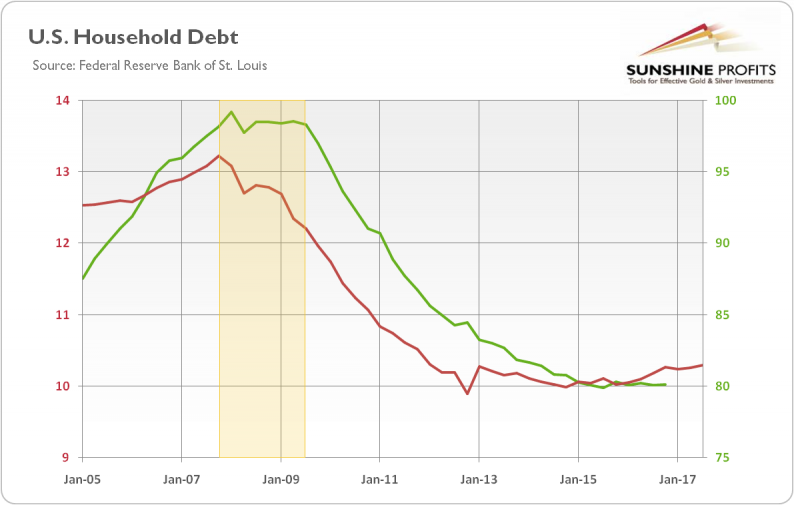

The best example may be the Great Recession. Prior to the financial crisis, U.S. households had been financing spending more and more by credit, boosting their leverage. Another mortgage? Why not, the house prices have to rise forever, right? We all know how the credit bonanza ended. When the home prices finally fell, while debt interest rates went higher, borrowers weren’t able to cover their debt servicing costs any longer. The households went under water and couldn’t roll over their debts. The economy started to deleverage, as one can see in the chart below. It was a healthy reset, but economic growth slowed down, as households had to tighten their belts.

Chart 1: U.S. household debt relative to GDP (green line, right axis, as %) and U.S. household debt service payments relative to disposable personal income (red line, left axis, as %) from 2005 to 2016/2017 (the yellow rectangle marks the recession).

What does it all imply for the gold market? Well, before we answer this question, let’s relate the debt cycles to the Kondratiev waves. In the autumn phase, there is speculative fever, as economic growth is fueled by debt and anticipation of ever-increasing asset prices. We believe that that phase occurred and was ended by the Great Recession. Then, winter came: the stock market crashed and the unemployment rate soared. And – importantly – there was asset price deflation and debt deleveraging (the deflation would have been larger if the central banks didn’t introduce ZIRP and quantitative easing). The interest rates were ultra low, but didn’t boost the credit expansion, as deleveraging dominated. Households didn’t want to take on new debt, since they had to pay back their previous loans.

Leave A Comment