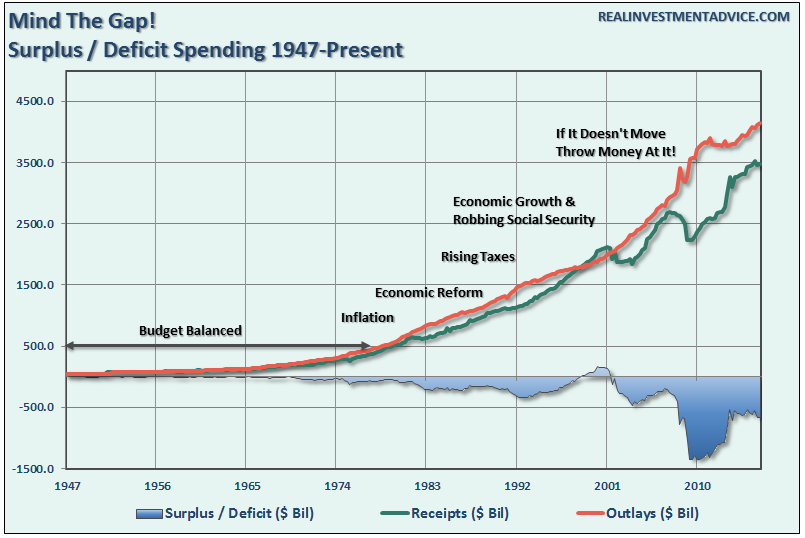

While the world has been focused on the Federal Reserve, the markets, and the upcoming election, few have noticed the expansion of the deficit in recent months which is now in excess of $667 billion up from a recent low of $530 billion. The chart below shows the history of U.S. surplus/deficit:

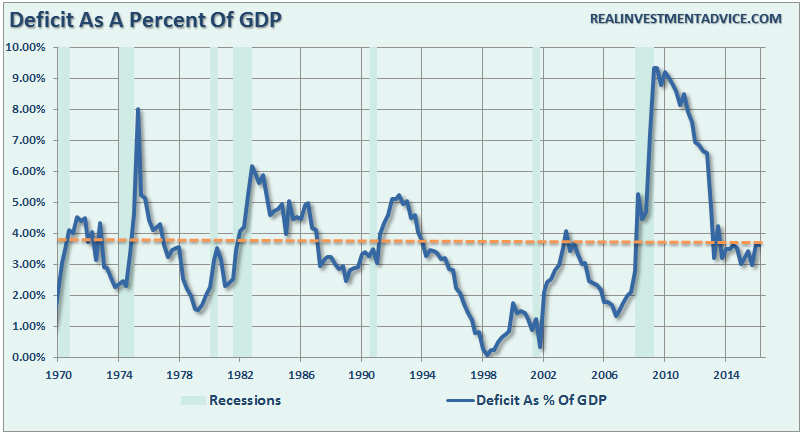

During the financial crisis, the deficit ballooned to a record of $1.35 trillion as tax revenue declined as Government spending swelled. Importantly, the Federal Deficit was approaching 10% in 2009, a historical record for the U.S., but still remains at levels associated with weaker economic growth rates and recessions.

The decline in the deficit was artificial in many ways as it was primarily due to the reforms from the “2011 Budget Control Act” which including tough spending cuts and a big tax bite that impacted a large majority of the middle class.Much of that “austerity” has now been reversed.

Tax The Rich

The surge in tax revenues was a direct result of the “fiscal cliff” at the end of 2012 as companies rushed to pay out special dividends and bonuses ahead of what was perceived to a fiscal disaster and higher tax rates. The large surge in incomes was primarily generated at the upper end of the income brackets where individuals were impacted by higher tax rates. Those taxes were then paid in April and October of 2013 and accounted for the sharp decline in the deficit. Also, it is important to remember that payroll taxes also increased due to the expiration of the payroll tax cut from 2010. (Note: the increased tax collection from payrolls remains currently.)

This surge in tax revenue can be seen more clearly in the chart below of tax receipts as a percentage of GDP.

While making the rich “pay their fair share” may increase revenue in the short run, over the longer term higher tax rates, and the subsequent redistribution of wealth leads to lower economic growth. Louis Woodhill put it best:

“To ‘tax’ is to take away something from someone and give it to the government. ‘The rich’ are rich because they own a lot of assets. So, what it means to ‘tax the rich’ is to take assets away from rich people and transfer them to the government.

So, what are the assets that the rich own? The rich don’t have money bins full of cash, like Scrooge McDuck. Rather, they own things like factories, office buildings, and oil wells, either directly or indirectly via stocks and bonds. In other words, the rich own most of the ‘nonresidential fixed assets’ of the nation. These assets certainly count as ‘wealth’, but what they are physically are the tools that workers use to produce America’s GDP.”

Leave A Comment