The headlines say wholesale sales were up month-over-month with inventory levels remaining elevated. Our analysis essentially agrees.

Analyst Opinion of this month’s Wholesale Sales

The improvement this month in the headline data was primarily due to electrical durable goods and petroleum. Overall, I believe the rolling averages tell the real story – and they marginally improved this month. The current trends are showing a slowing in the rate of growth.

Inventory levels remain elevated but below recessionary levels.

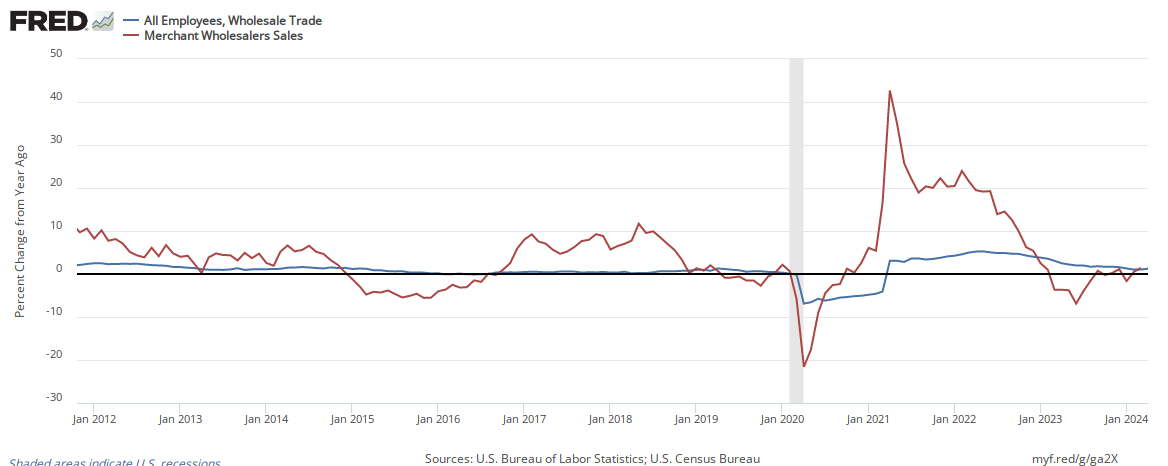

To add to the confusion, year-over-year employment changes and sales growth do not match.

Note that Econintersect analysis is based on the change from one year ago. Econintersect Analysis:

US Census Headlines based on seasonally adjusted data:

Wholesale sales were at record highs for almost two years – until 2015 where they contracted year-over-year – this contraction ended in 2017. Overall, the inventory-to-sales ratios is slowly returning to normal.

Unadjusted Inventory-to-Sales Ratio – Percent Change From One Year Ago

Year-over-year change in the inventory-to-sales ratio is what is important. A jump in the ratio which could indicate a slowing economy (one month of data is not a trend). A flat trend would indicate an economy which was neither accelerating or decelerating. A decelerating trend would indicate an improving economy.

Leave A Comment