(Photo Credit: Bernal Saborio)

Delta Air Lines (DAL): Industrials – Airlines | Reports April 12, Before Market Opens

Key Takeaways

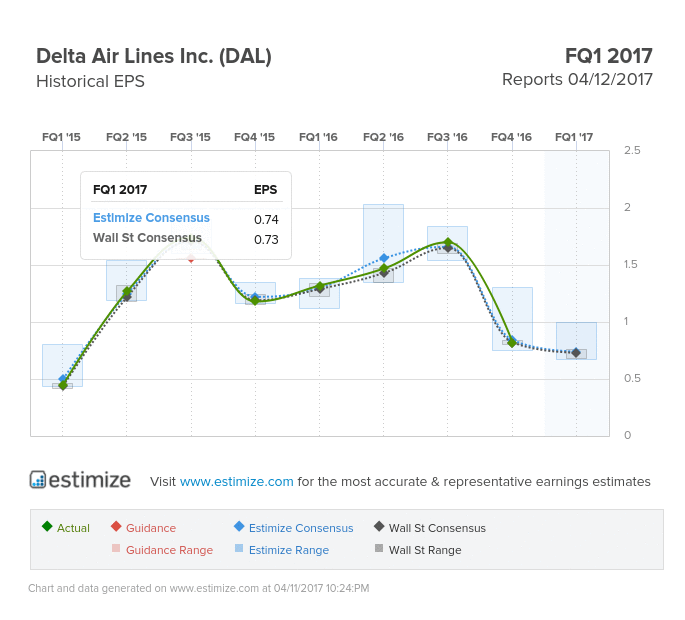

Delta Airlines (DAL) is soaring into its first quarter earnings this Wednesday with falling expectations. In the last 3 months, EPS estimates for the international carrier have dropped 20%, with revenues remaining flat. Currently the Estimize consensus is looking for EPS of $0.74, 1 cent above Wall Street, with revenue expectations of $9.2 roughly in line with the Street. Compared to the same period last year, this represents a projected 44% decrease on the bottom line. Historically Delta has beaten the Estimize consensus in 54% of reported quarters.

Delta was one of of the top performing U.S. airlines in 2015 and the first half of 2016 despite mixed earnings in the past 2 years. However, last quarter the airliner missed bottom-line expectations by 2 cents, recording a YoY decline in growth of 45%. Revenues however impressed, coming in around $100M higher than anticipated, but flat on a year-over-year (YoY) basis.

Revenue has been the airline’s biggest problem, continually coming in flat or negative YoY. Choppy domestic pricing on top of weaker business travel trends had a material impact on results in fiscal 2015. Moreover, key metrics including PRASM (passenger revenue per available seat mile) continue to fall short of expectations. Just last week Delta cut it’s Q1 unit-revenue forecast to -0.5%, blaming weakened ticket sales closer to departure.

Leave A Comment