By: Rupert Hargreaves

Assets around the world are at peak valuations, according to Deutsche Bank AG, which released its annual Long-Term Asset Return Study a few days ago.

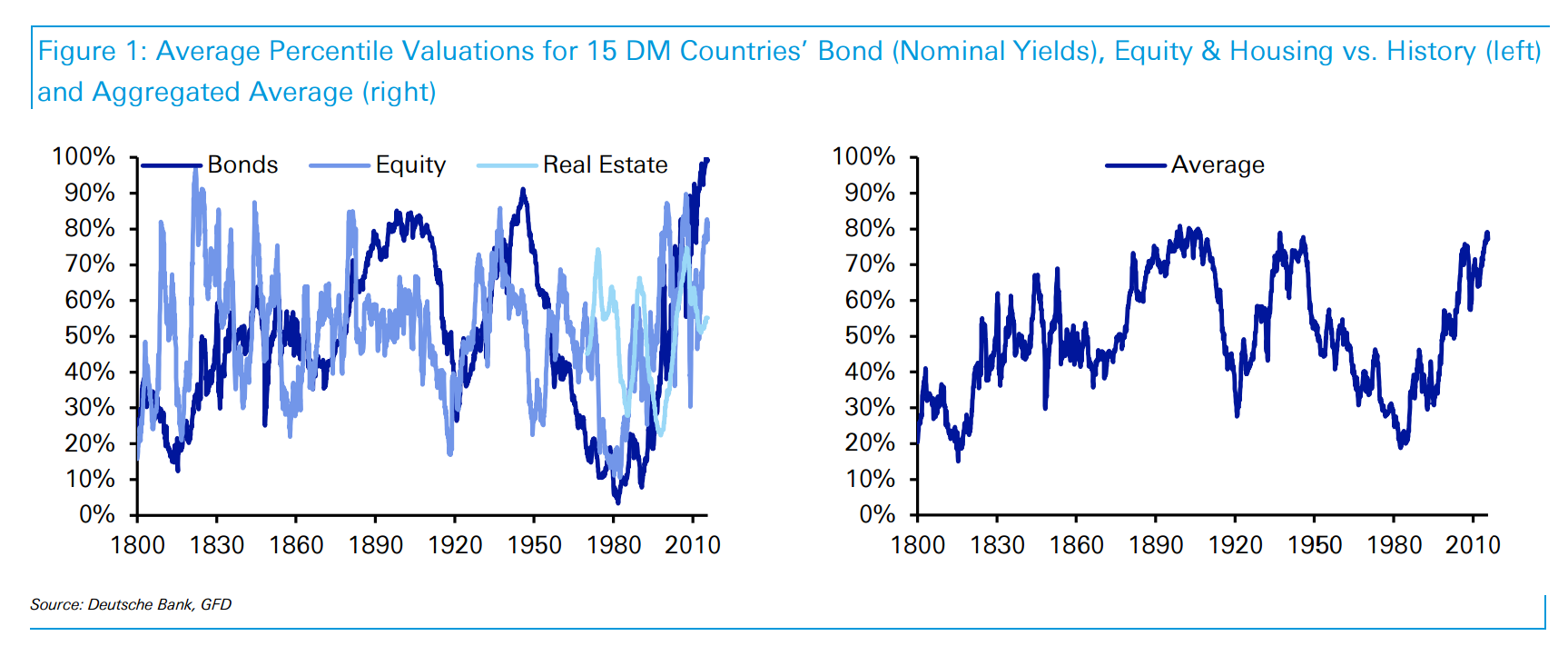

This year’s volume of the asset return study is aptly named Scaling The Peaks, as the data presented in the report shows that at least three major asset classes, bonds, stock and real estate are all trading close to peak valuation levels relative to history. To see a well constructed counterargument on using 200 years of data see this piece by Josh Brown of The Reformed Broker.

Assets are at ‘peak valuation’

Deutsche Bank examined over 200 years of data to arrive at this conclusion and looking through the data they found that:

“Looking at three of the most important assets (bonds, equities and housing) across 15 DM countries, with data often stretching back two centuries, we are currently close to peak valuation levels relative to history. Indeed when aggregated, current levels are higher on average across the three asset classes than they were back in 2007/08 and certainly higher than in 2000. At the equity market peak back in the summer months of 2015 we were pretty much at the peak.”

Assets have reached ‘Peak Valuation’

The recent market correction should be viewed in context with these charts. It’s clear that global central bank liquidity and asset purchases have pushed asset prices to these levels. The problem is, that as the Federal Reserve gets closer to initiating a tightening cycle the risk of a further correction in global asset prices increases.

Deutsche Bank’s data shows that rate hikes generally take time to impact the economy. Real GDP tends to climb for around six months after the rate cycle turns, before drifting lower. Based on data from the twelve US hiking cycles since 1950, it has taken between 11 and 41 months for an economy to fall into recession after the first rate hike. Historic data also shows that equities continue to climb initially but seem to stall 12-24 months after the first hike. Bond yields generally climb during the 12 months following the first rate hike.

Leave A Comment