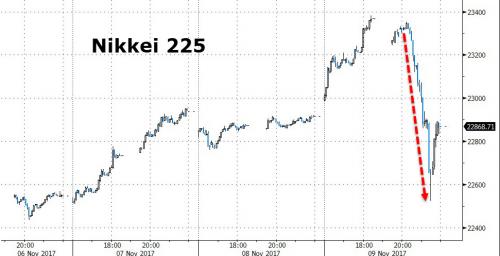

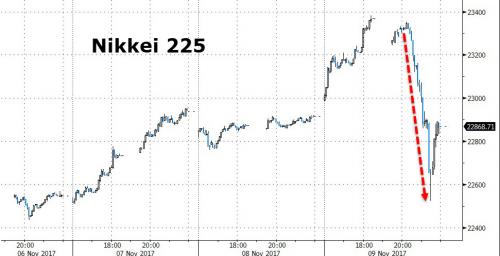

One week ago, on November 9 something snapped in the Nikkei, which in the span of just over an one hour (from 13:20 to 14:30) crashed more than 800 points (before closing almost unchanged) at the same something snapped in the Nikkei, that foreigners had just bought a record amount of Japanese stocks the previous month.

As expected, numerous theories emerged shortly after the wild plunge, with explanation from the mundane, i.e., foreigners dumping as the upward momentum abruptly ended, to the “Greek”, as gamma and vega stops were hit by various vol-targeting (CTAs, systemic, variable annutities, and risk parity) funds. One such explanation came from Deutsche Bank, which attributed the move to a volatility shock, as “heightened volatility appears to have triggered program trades to reduce risk”, and catalyzed by a rare swoon in both stocks and bonds, which led to a surge in Nikkei volatility…

… and forced highly leveraged risk parity funds and their peers to quickly deliver. As DB’s Masao Muraki explained at the time:

[the] increase in stock (or stock and bond) volatility might trigger position cutbacks when hedge funds, CTAs, and others engage in trading with higher leverage. In fact, stocks and bonds weakened from about 13:20 in the Japanese market on 9 November

The involvement of risk-parity funds in the Nikkrash was hardly a surprise because as we noted in “Global Stock, Bond Selloff Accelerates Amid Risk-Parity Rumblings” risk parity proxies had just suffered their worst day since July:

Risk Parity not having a good day pic.twitter.com/GRdpB4NUOj

— zerohedge (@zerohedge) November 10, 2017

In good news for “market stability targeting” central banks around the globe, that moment of sheer risk-parity turmoil was confined to that day, and in a follow up note released today Muraki writes that Japanese equities “have broadly returned to our model as of the 15th (there was a small volatility shock on that day as well).”

Leave A Comment