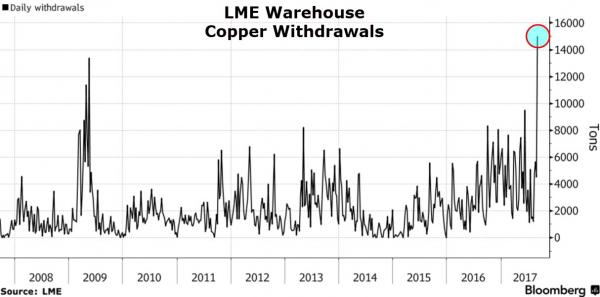

Buyers withdrew more copper from the London Metal Exchange’s global warehouse network on Wednesday than at any time since daily records began in 1996, extending a 19-day drop.

As Bloomberg notes, while the net decline in percentage terms was also the biggest since the height of China’s raw-materials boom in 2006, some have warned against reading such moves as an end to a years-long supply glut. A tug of war between financial traders with opposing views of the market has led to sharp swings in metal moving in and out of storage in the past year.

However, stockpiles also slumped 8.2% on the Shanghai Futures Exchange, which is notable because last year we saw the London and Shanghai inventories see-sawing (up in London, down in Shanghai, and vice versa)…

A question that emerged is what China is spending all this newly created money on. One answer emerged overnight when Bloomberg reported that after tumbling in the first half of 2015, copper inventories at the Shanghai Futures Exchange had been steadily rising, and in the most recent week soared by 11% to an all time high of 305,106 tons.

At the same time reserves at the London Metals Exchange declined for 11 days to the lowest level in more than a year, in other words China is shifting idle inventory from Point A to Point B.

But, this most recent withdrawal surge (the largest in history) suggests a sudden failure of the long-running commodity “collateralization” transaction – or CCFD – regime implemented in China years ago, as described in this post and summarized in the chart below…

To summarize, Goldman notes that these shadow banking vehicles – CCFDs – involve a long copper physical positions and a short futures position on the LME.

And so, the current crackdown on leverage in the system by Chinese authorities may be forcing unwinds of the CCFDs – thus putting upward pressure on Copper futures (unwinding short positions) and selling physical copper (which would mean procuring the physical metal before passing it on). These are exactly what we are seeing in the market currently.

Leave A Comment