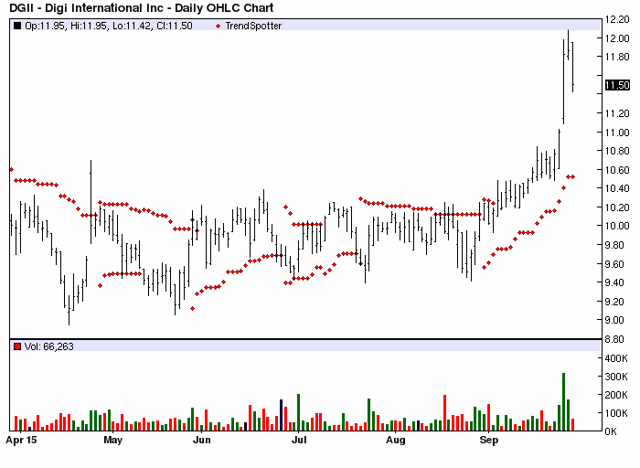

The Chart of the Day is Digi International (NASDAQ:DGII). I found the communications equipment stock by using Barchart to sort the Russell 3000 Index stocks for stocks with technical buy signals of 80% or better and a Weighted Alpha of over 50.00+. Since the Trend Spotter signaled a buy on 8/31 the stock gained 12.01%.

Digi International Inc. is a worldwide provider of communications hardware and software delivering seamless connectivity solutions for peripheral server-based remote access and local area networking markets. The Company operates exclusively in a single business segment and sells its products through a global network of distributors, systems integrators, value-added resellers and original equipment manufacturers. They also sell direct to select accounts and the government.

(click to enlarge)

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

Fundamental factors:

Leave A Comment