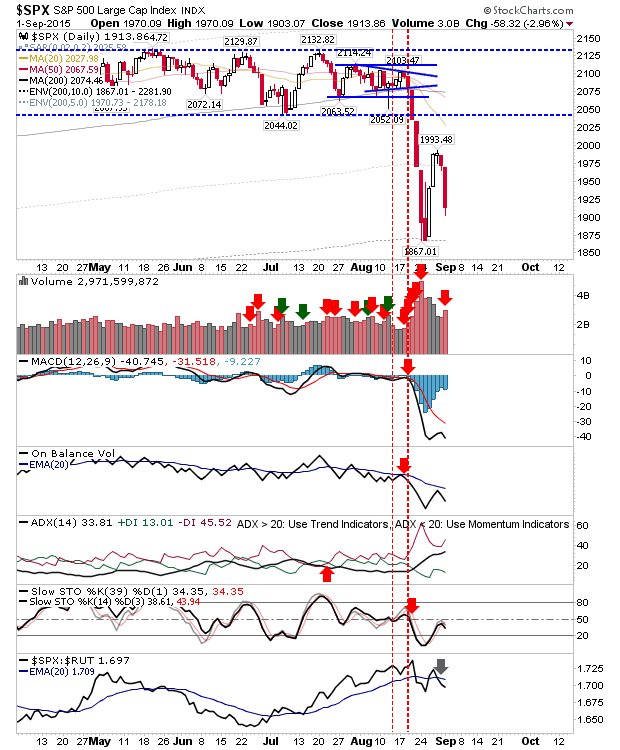

After the late recovery last week, sellers again made markets their home. Sizable losses were accompanied with higher volume distribution, although volume was down on earlier panic. Another pass at August lows looks likely.

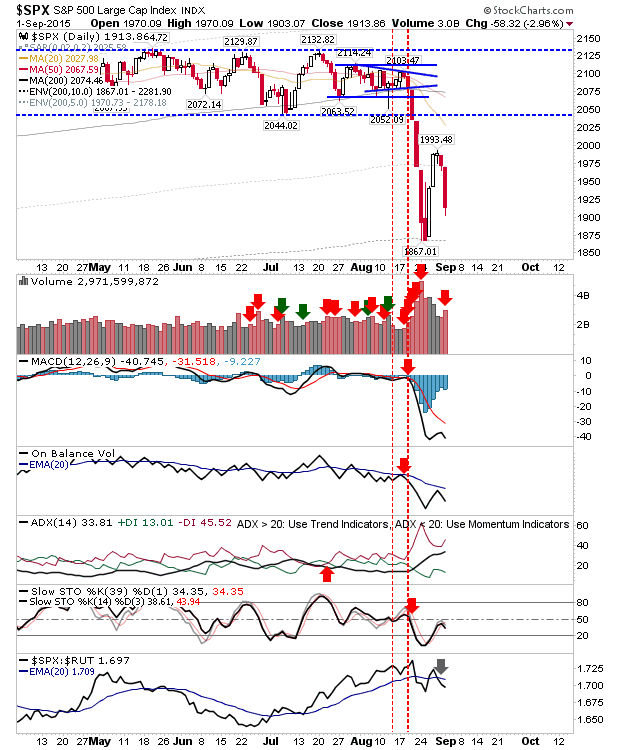

The S&P is again heading to the 10% 200-day MA envelope. Relative performance is shifting away from Large Caps to more speculative indices, which is bullish in a rising market, but in a falling market suggests a lack of sanctuary.

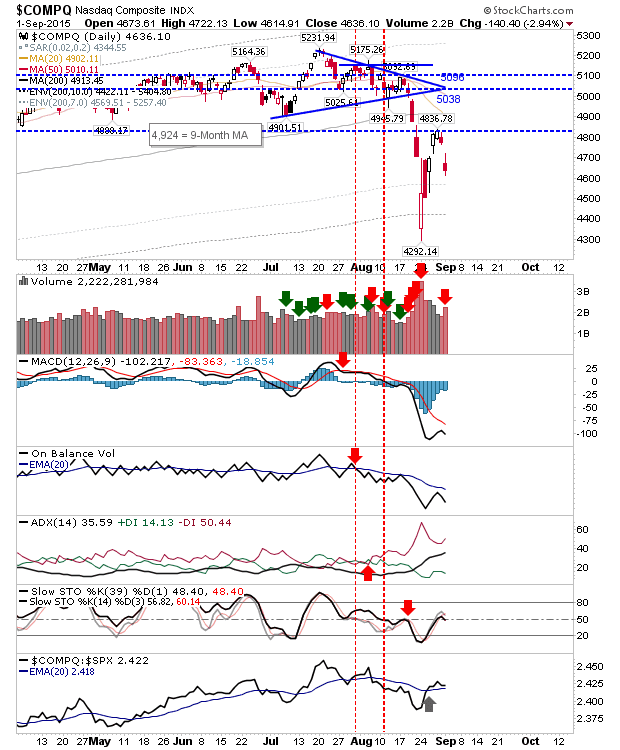

The Nasdaq is also in the early stages of a retest of the August low. Technicals are weak, although stochastics crept above the bullish mid-line, but not enough to suggest bulls have an opportunity. It may take another run at oversold stochastics to wash this one out.

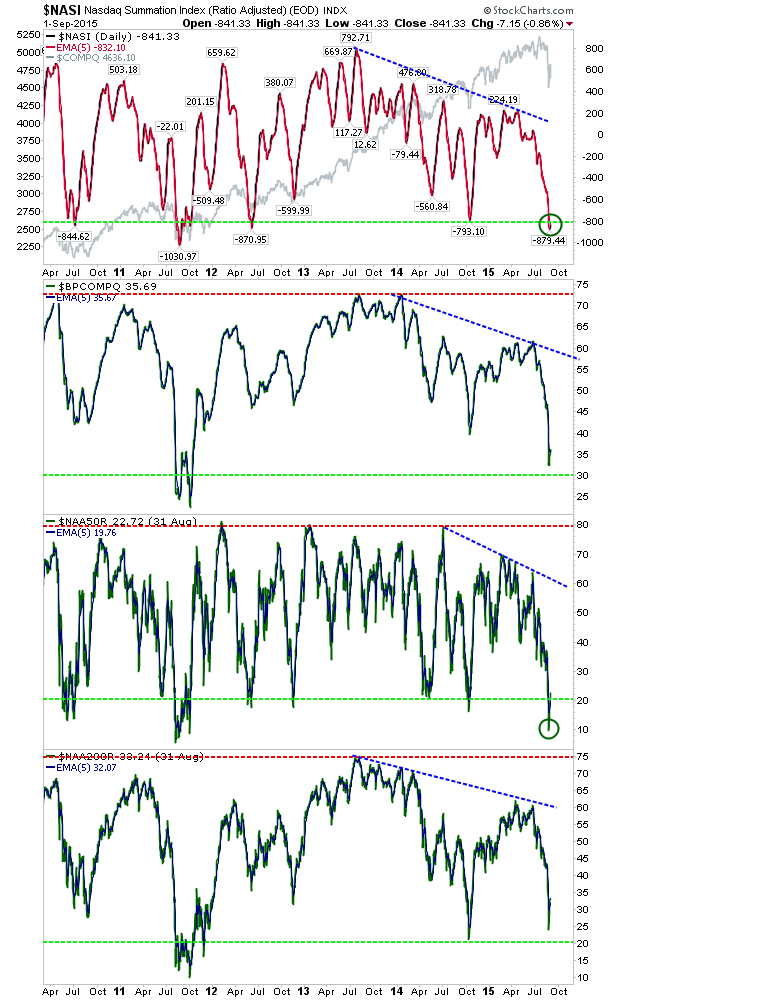

However, Nasdaq market breadth is getting close to a bottom, if not having reached one already. Only the 2011 had a more oversold low.

The Russell 2000 is also moving down to its low of last week. Of the indices, it’s enjoying the best relative performance, and indications of a bottom may appear in this index first. But for now, it’s a wait and see.

Indices look set for another run at the August lows, so further downside looks favored. But let the markets decide. Market breadth suggests a trade-worthy bottom is close, and value buyers would be doing well to shop around.

Leave A Comment