Jobs are well understood to be a lagging indicator, but economists cling to the notion that initial unemployment claims lead.

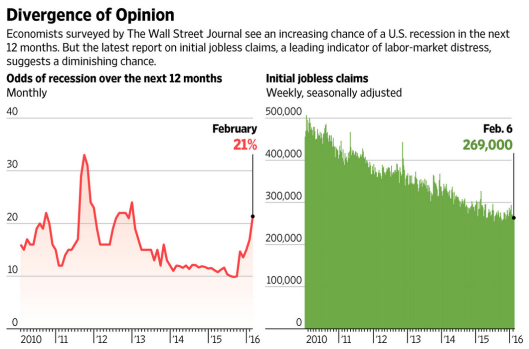

Despite stress-free readings in initial claims, Economists, CEOs: say Recession Risk Rising. The Wall Street Journal calls this a “divergence of opinion“.

The odds of recession in the next 12 months have climbed to 21%, double the level of a year ago and the highest since 2012, according to the average estimate in The Wall Street Journal’s monthly survey of economists. Economists at Bank of America Merrill Lynch peg the chance of recession in the next 12 months at 25%.

Fed Chairwoman Janet Yellen said Thursday in testimony before the Senate Banking Committee that she sees several risks to the U.S. economy and that the central bank is carefully monitoring global financial markets and economic developments that could affect growth.

But she reiterated her view that a contraction isn’t imminent. “There is always some chance of a recession in any year, but the evidence suggests expansions don’t die of old age,” Ms. Yellen said. “It is not what I think is the most likely scenario.”

Initial Claims

The last seven recessions all ended with a sudden drop in initial claims following a spike high. In contrast, the last seven recession starts were nebulous at best. They did start from a bottom, but signals certainly were not clear.

Is there any reason to suspect initial claims will be even more nebulous this go around? Yes, many reasons actually.

Finally, I have been pondering a “Job Gain Recession”

Leave A Comment