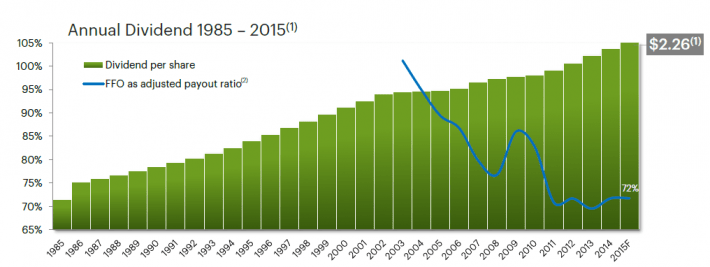

HCP (HCP) is one of a kind. It is the only REIT that is also a Dividend Aristocrat.

As a REIT, HCP must pay out at least 90% of its income to shareholders. The fact that HCP has increased its dividend payments for 30 consecutive yearsshows while paying out 90%+ of its profits to shareholders shows the tremendous stability the company’s operations possess.

Source: HCP REITWorld Conference Presentation, slide 9

There are 3 large players in the health care REIT industry. Each is shown below, along with market cap:

HCP Business Overview

HCP operates a portfolio of more than 1,000 properties in the United States and British Isles.

The company operates in 5 segments within the health care industry. Each segment is shown below along with the percentage of projected total net operating income generated for the company in 2015

HCP’s Competitive Advantage

HCP’s competitive advantage comes from its diverse portfolio of health care properties and its size.

HCP’s portfolio of over 1,000 health care properties minimizes the risk that any one deal possess. Smaller REITs are less diversified, and more subject to risks from individual deals.

HCP’s diversified portfolio is responsible for its 30 consecutive years of dividend increases.The company is diversified not only in the number of properties it owns, but also in the type of health care properties it control.

HCP generally locks its customers into contracts that specify rent increases throughout the course of the contract.The image below shows how HCP’s diversified portfolio and contractual rent obligations give it sustainable growth.

Leave A Comment