You may be more familiar with McGraw-Hill Financial (MHFI) by its very widely used (at least in investment circles) S&P brand.

Not only is McGraw-Hill Financial a Dividend Aristocrat – but the company actually created the Dividend Aristocrats Index.

McGraw-Hill was created in 1917 with the merging of the McGraw Publishing Company and the Hill Publishing Company. In 1957, the company introduced the S&P 500. Today, McGraw-Hill Financial has a market cap of over $25 billion.

In 2011, McGraw-Hill announced that it would split its financial and education businesses. The split was completed in 2013 when Apollo Global management purchased the education side of the business for $2.5 billion.

Business Overview

McGraw-Hill Financial is organized into 4 business segments:

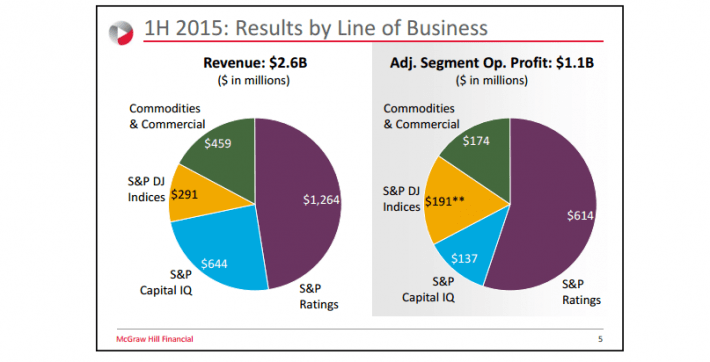

The image below gives a graphical overview of the size of each business segment

Source: McGraw-Hill Financial Barclays Presentation, slide 5

The S&P Ratings line of business rates corporate and government debt, rates bank loans, and provides corporate credit estimates. The business also provides credit surveillance, customer-relationship pricing programs, and entity credit ratings.

The company’s second largest business line is its S&P Capital IQ Business. This business provides data feeds and enterprise solutions, credit ratings related informational products, investment research products, and advisory services for pricing and analytic analysis.

The S&P DJ Indices division generates revenue through licensing its name to investment products, through data subscriptions and custom indexes, and through creating OTC and custom derivative products.

Finally, the Commodities and & Commercial division provides news, data, price assessments, consulting, and custom research for the construction and automotive industry. The Commodities & Commercial business line operates primarily under the Platts, J.D. Power, and McGraw Hill Construction names.

Leave A Comment