Since we first uncovered the importance of dividend futures for anticipating future stock prices, we’ve been keeping track of that data on a regular basis.

Doing that has been a valuable exercise, not just because of our primary use for the data, but also because it gives us the ability to recreate what the future expectations of investors were on any trading day in the past for which we have the data.

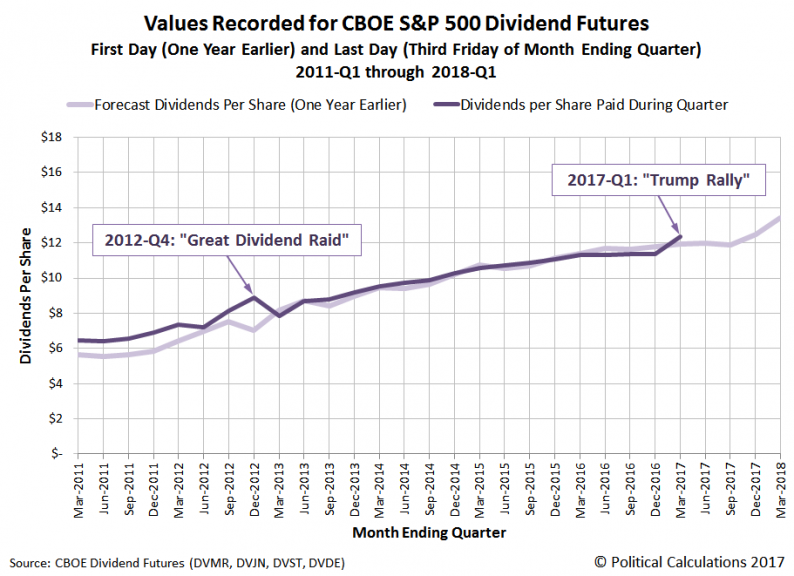

For the Chicago Board of Exchange’s dividend futures contracts, that history extends back to when they were first rolled out back in early 2010. We thought it might be interesting to compare what the future for dividends in each quarter looked like on the first day that the dividend futures contract for a given future quarter went into effect (one year before the futures contracts for it expires on the third Friday of the month ending the quarter for which it applies) and the value of the amount of dividends paid out during that quarter on the last day before its dividend futures contract expired.

The results are presented in the following chart:

The chart begins with a comparison of the results between the dividend futures data for 2011-Q1 that was first published in March 2010 and the value of the dividend futures contract indicating the amount of the S&P 500’s dividends per share would be paid out by the time that the dividend futures contract for 2011-Q1 expired on the third Friday of the March 2011.

Aside from the CBOE’s dividend futures contracts’ first year and a half, where the final day’s dividend values had risen well above their initially recorded values, we see that there has generally been pretty close agreement between the initially forecast value and the value recorded on most dividend futures contracts’ final day.

There are however two exceptions that stand out. The first is the event we’ve describes as “The Great Dividend Raid of 2012”, where if you want to find out more about how the fear of higher dividend tax rates that were set to take effect in 2013 caused dividend payouts (and stock prices) in 2012-Q4 to surge so much higher than their initially forecast values, be sure to follow the The Great Dividend Raid of 2012!

Leave A Comment