Shares of oil refining giants Phillips 66 (PSX) and Valero (VLO) have more than doubled in the past five years.

This might come as a surprise, since the oil industry is currently in the midst of one of its worst downturns in decades.

And yet, Phillips 66 and Valero continue to pump out strong profits. Even better, they reward their shareholders with hefty dividend payouts.

Neither company is a member of the Dividend Achievers—a group of a group of 272 stocks with 10+ years of consecutive dividend increases. You can see the full Dividend Achievers List here.

That said, both stocks stand a great chance of becoming Dividend Achievers eventually. In the meantime, they offer above-average dividend yields, and annual dividend increases of 10% or more.

But which dividend growth stock is better? This article will attempt to answer that question.

Business Overview

Both Phillips 66 and Valero are oil refiners. Their main business model is to receive crude oil process it into, gasoline, diesel fuel, heating oil, and other refined petroleum products.

Phillips 66 and Valero each have huge networks and assets.

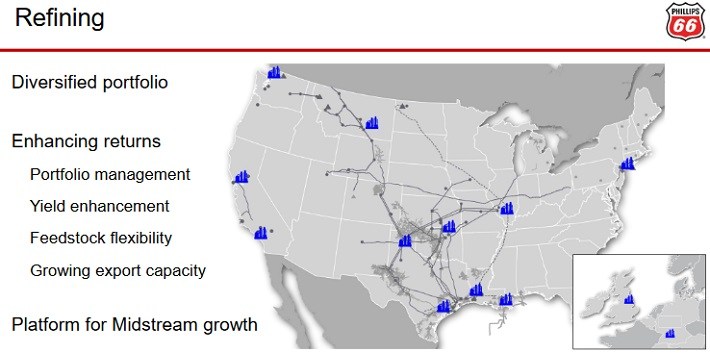

First, Phillips 66 was spun-off from oil and gas producer ConocoPhillips (COP) in 2012. It is a more diversified company than the average refiner—it has a chemicals and marketing segment.

Still, Phillips 66 at its core, is a refiner.

Source: November Investor Presentation, page 15

Valero is a refining pure-play. Like Phillips 66, it has a nationwide footprint.

Source: January 2017 Investor Presentation, page 4

One difference in their asset bases is that Valero has a concentration in the Gulf region. More than 55% of Valero’s refining capacity is located in the U.S. Gulf Coast, approximately double Phillips 66’s concentration in that region.

Business prospects for both companies remain sound, as it pertains to demand. Utilization for Phillips 66 and Valero both have held utilization ratios above 95% over the past year.

Leave A Comment