Each month I will publish my dividend income. I will mainly do this for staying self motivated and to give you the readers the chance to follow my journey from the beginning on. The dividend income in the first couple of years will be on a very low level but investing in dividend stocks is all about the long term. I am very sure that in 5 years from now I will get my first rewards for the patience and focus on my goals.

It is again time for the monthly dividend income summary, can’t believe that is already July. But yeah my dividend income in June was just amazing I crossed the first the 200 EUR mark. Crossing this number is truly a great feeling and it simple means with my dividend income I cover about 20% of my monthly expenses. Furthermore it is already my 4th month in a row that I am in triple digits when it comes to my monthly dividend income. Of course I have to mention that my June income was highly effected by the one time payer Uniqa Insurance, an austrian insurance company.

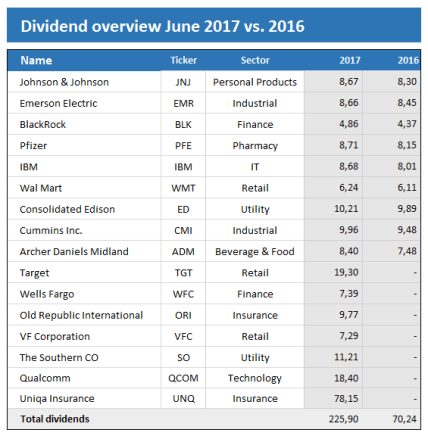

Overview dividend income June

My total dividend income in June was 225.90 EUR that is an increase of 221.61% compared to June 2016. That increase does mainly come from my additional investment in Target, Wells Fargo, Old Republic VF Corporation The Southern, Qualcomm and of course Uniqa Insurance. I am also still happy to announce that none of my stocks has cut their dividends so far, compared to the last year all of the stocks mentioned above have increased the dividend. Nevertheless I also do know that I will not reach the number this year again but even without Uniqa Insurance it would have been a great month. I also have to mention that my accumulated yearly dividend income is already above the total of 2016. Currently I have collected dividends worth of 749.69 EUR compared to 706.26 EUR in 2016. Considering my further investments I more than confident to reach my goal of 1 400 EUR Dividend Income in 2017.

Leave A Comment