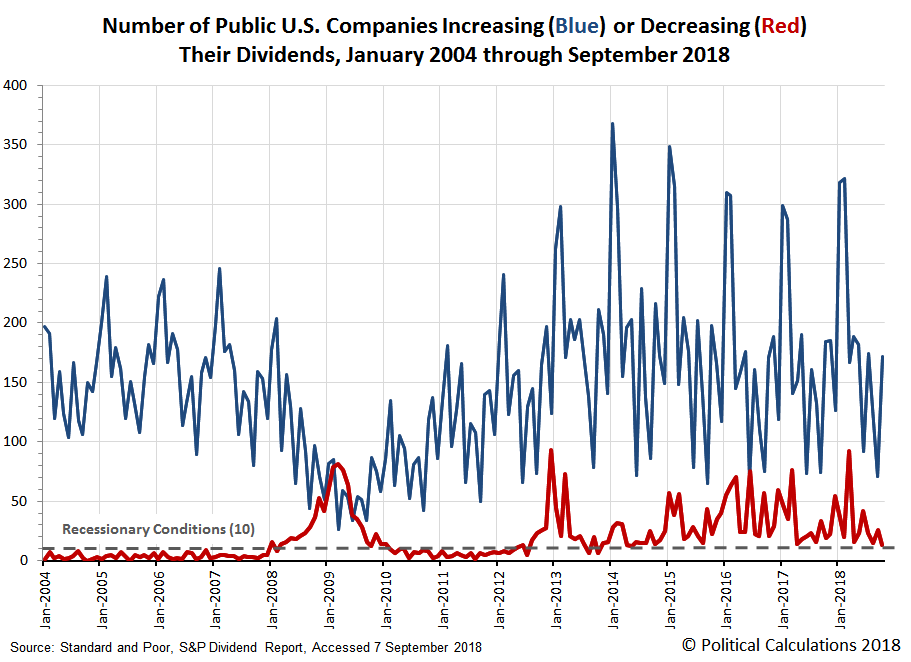

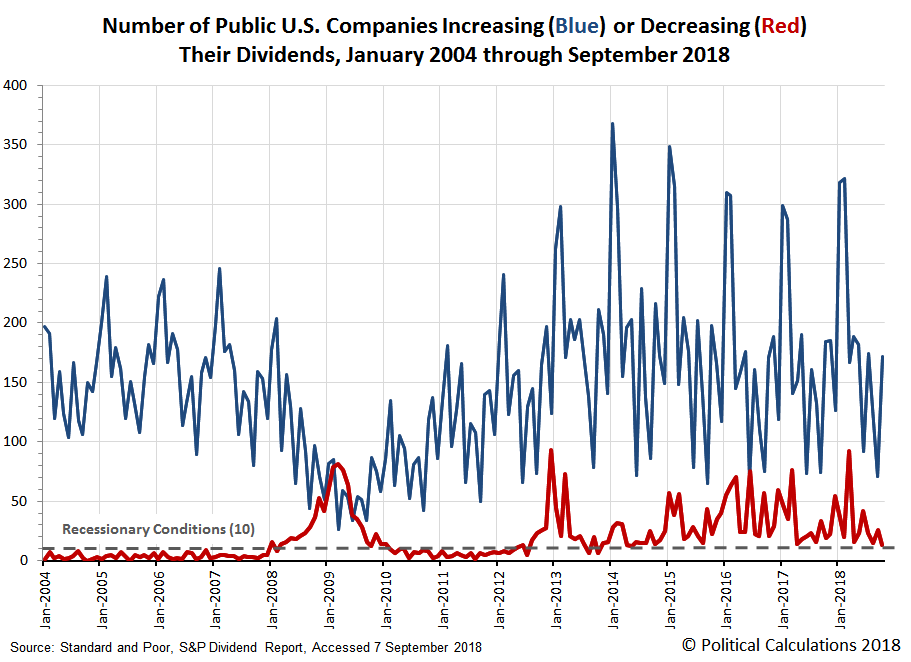

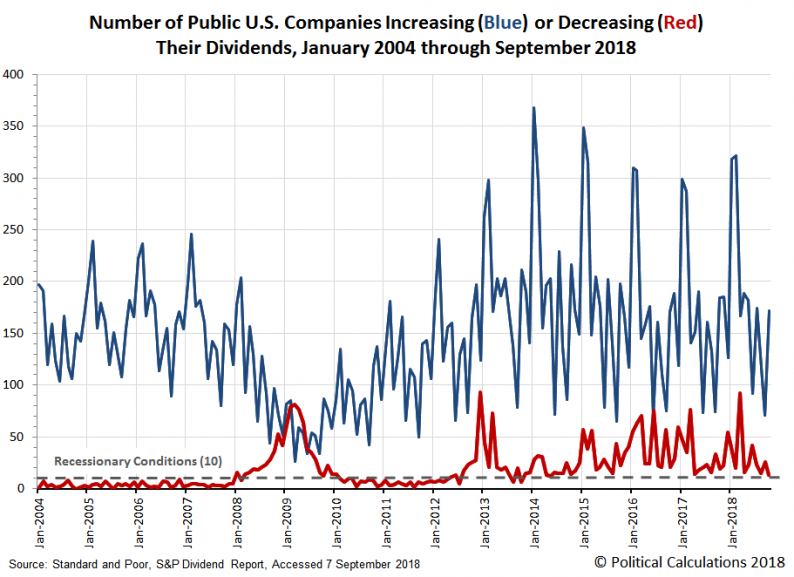

Following what is seasonally the weakest month for dividend-paying firms in the U.S. stock market, October 2018 was, by comparison, solid but not spectacular. The following chart shows how the number of dividend increases and decreases announced during the month compares with all the previous months for which we have data.

For October 2018, the chart shows a rebound in the number of firms increasing dividends and also a decrease in the number of dividend cut announcements during the month, as reported by S&P. Unfortunately, the number of reported dividend cuts during the month may not be as good as it looks, which we’ll discuss more after we run through the dividend numbers for the month.

No fewer than 3,654 firms declared dividends in October 2018, an increase of 31 over the 3,623 that made similar declarations in September 2018, and up dramatically (577) from the 3,077 that issued dividend declarations in October 2017.

There were 38 announcements related to paying an extra, or special, dividend payment to shareholders in October 2018. While that figure represents an increase of 14 over the 24 extra dividends that were announced in the previous month, it represents a decrease of 3 firms from the total of 41 that were registered in the previous October.

172 firms declared that they were increasing their cash dividends in October 2018, up by 101 from September 2018’s seasonal low total of 71 firms. October 2018’s total was 12 fewer than the 184 that was recorded in October 2017.

Standard and Poor counted just 13 dividend cuts in October 2018, down from the total of 26 they counted in September 2018. This figure was also six less than the 19 that were counted in October 2017.

Two firms declared that they would omit paying dividends during the month, rising by one from September 2018’s total of one, but down by four from October 2017’s count of six dividend-omitting firms.

Leave A Comment