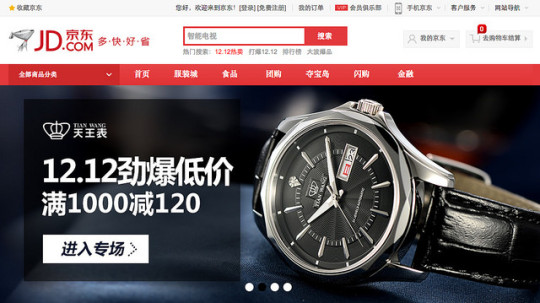

Photo Credit: John Pasden

JD.com, Inc. (JD) Consumer Discretionary – Internet & Catalog Retail | Reports March 01, Before Market Opens

JD.com (JD) is scheduled to report fourth quarter earnings tomorrow, before the opening bell. The company has emerged as a disruptive force in China’s burgeoning retail space by offering authentic and specialty products. Unlike Alibaba, JD.com follows an asset heavy model with wholly owned products and self-built distribution channels. Despite delivering weaker than expected earnings last quarter, the company managed to report robust YoY growth.

This quarter, the Estimize consensus is calling for EPS of $0.01 and revenue of $8.16 billion, 39% higher than Wall Street on the bottom line and $17 million greater on the top. However our Select Consensus, which more heavily weights historically accurate analysts and recent estimates, is expecting a more modest beat of 2 cents. The company has been seeing unfavorable revision activities with EPS estimates trending down 24% in the past three months. Compared to Q4 2014, this represents a projected decline in profitability of 23% while sales are expected to grow 46%. Historically, JD.com has consistently beat Wall Street, trumping revenue estimates in 100% of earnings reports. The company’s focus to ensure long term growth should help drive revenue but will adversely impact profitability in the near term.

Despite Alibaba’s commanding 80% of the ecommerce market in China, JD.com has succesfullly distinguished itself as the primary purveyor of authentic merchandise. In recent years, the company has improved margins with a mix in product offerings and greater contribution from its marketplace business. JD.com has quickly opened its marketplace to third party vendors and now has over 75,000 merchants on its platform. The retailer’s continued efforts to develop its marketplace platform, expand fullment capabilities and enhance its strategic partnerships, positions JD.com to for robust growth. That said, JD.com carries high operating expenses from a costly fulfilment infrastructure and an agressive expansion strategy which is expected to weigh on profitablity.

Leave A Comment