Folks are still scratching their heads about the high yield selloff.

Apparently, “it was and still is a bubble” and/or “spreads have become completely disconnected from leverage” are no longer acceptable explanations for mini-corrections. That kind of thinking is no longer allowed. You can’t simply get out because you no longer want to play the greater fool game. If you can’t come up with a “good” reason why you’re not still long, well then you have broken the rule that’s implicit in risk assets these days: namely that any behavior which is not conducive to higher highs on equities and tighter tights in credit is illegal.

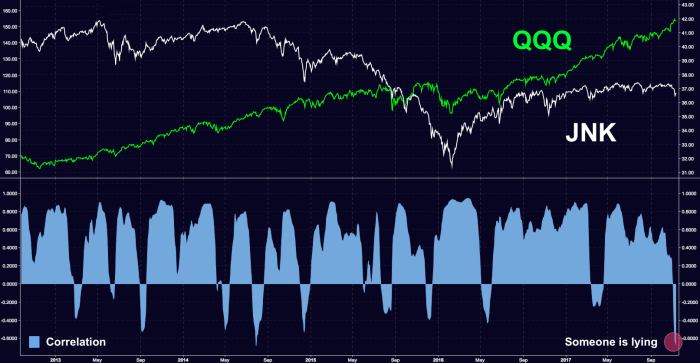

Particularly vexing for market participants last week was the notion that stocks and junk were saying two different things. That’s captured in this chart which shows the normally positive correlation between the Nasdaq 100 and one of mom-and-pop’s favorite junk bond ETFs turning sharply negative:

What didn’t seem to occur to anyone last week is that it may no longer make much sense to compare anything to the S&P 500 and the Nasdaq 100. Consider this out from Barclays:

On the surface, the recent weakness in credit stands out, particularly when compared with the performance of the S&P 500, which set a new all-time high on Wednesday. From October 24 to November 8, the S&P 500 rose 1%. But drilling down further into S&P 500 performance, we find that much of the rally was due to the outperformance of the technology sector, which rose nearly 6% over the period and accounts for nearly 25% of the index. And in fact, the next two largest sectors in the index, financials and healthcare, which each account for 14% of the index, were down over the period (financials -2.2%, healthcare -1.7%).

In the same vein, look at the Russell plotted with the Bloomberg Barclays High Yield index:

Now here’s the same chart, only with the Nasdaq 100:

Leave A Comment