Dogecoin chart analysisDogecoin price recovered in the second part of the day yesterday. Bullish consolidation pushed the price to the 0.09500 level this morning. After that, we encounter an open in that zone and the price begins to pull back to the 0.09300 level. Here, we are now testing the EMA50 moving average in the hope of finding its support. A drop below would indicate a further pullback and look for support at lower levels. Potential lower targets are 0.09200 and 0.09100 levels.We need a positive consolidation and a move to the 0.09400 level for a bullish option. Then, we would have to hold up there in order to trigger a further recovery to the bullish side from there. Potential higher targets are 0.09500 and 0.09600 levels.  Shiba Inu chart analysisShiba Inu’s price managed to climb above the 0.00001100 level this morning. A high was formed at the 0.00001110 level, and after that, we see a pullback to support at the 0.00001070 level. Additional support in that zone is the EMA50 moving average, which, in this case, stopped this pullback. Cena gains support and begins a recovery. We are now looking to the upside again and expect to see a new rally in the price.Potential higher targets are the 0.00001110 and 0.00001120 levels. We need a negative consolidation and pullback below the 0.00001060 level for a bearish option. By doing so, we would fall below the EMA50 moving average, which would further strengthen the bearish pressure. Potential lower targets are 0.00001050 and 0.00001040 levels.

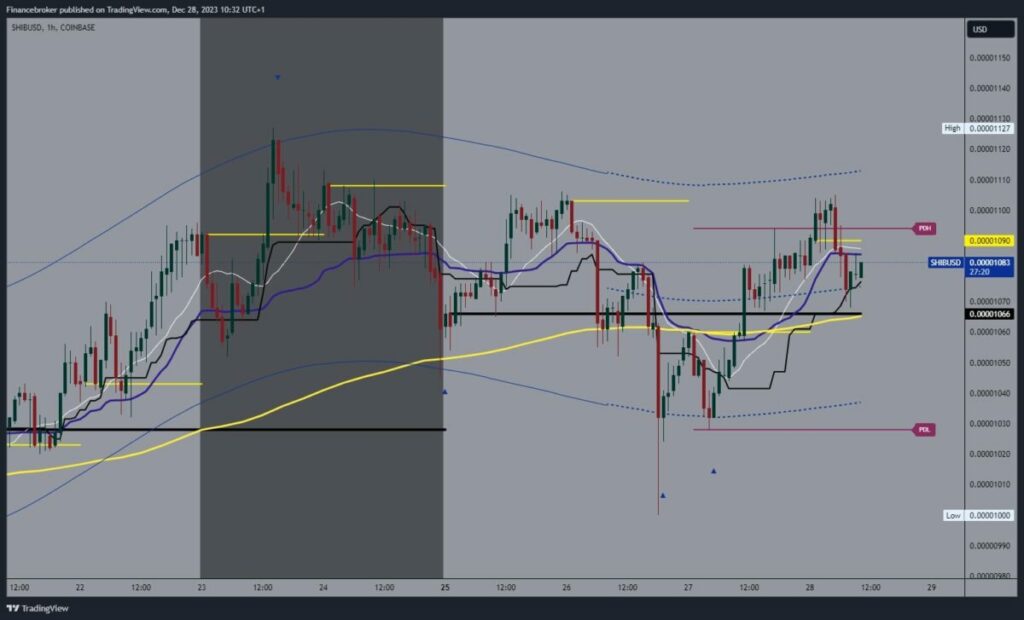

Shiba Inu chart analysisShiba Inu’s price managed to climb above the 0.00001100 level this morning. A high was formed at the 0.00001110 level, and after that, we see a pullback to support at the 0.00001070 level. Additional support in that zone is the EMA50 moving average, which, in this case, stopped this pullback. Cena gains support and begins a recovery. We are now looking to the upside again and expect to see a new rally in the price.Potential higher targets are the 0.00001110 and 0.00001120 levels. We need a negative consolidation and pullback below the 0.00001060 level for a bearish option. By doing so, we would fall below the EMA50 moving average, which would further strengthen the bearish pressure. Potential lower targets are 0.00001050 and 0.00001040 levels.  More By This Author:Bitcoin And Ethereum: Ethereum Breaks Above The $2400 Level Emerging Market Currencies Gain Momentum Against U.S. DollarUnderstanding The American Dollar Rate Dynamics As 2023 Ends

More By This Author:Bitcoin And Ethereum: Ethereum Breaks Above The $2400 Level Emerging Market Currencies Gain Momentum Against U.S. DollarUnderstanding The American Dollar Rate Dynamics As 2023 Ends

Leave A Comment